Weekly Reading for 9/4-9/8

Still time for the Fall ?

Quick look at last week:

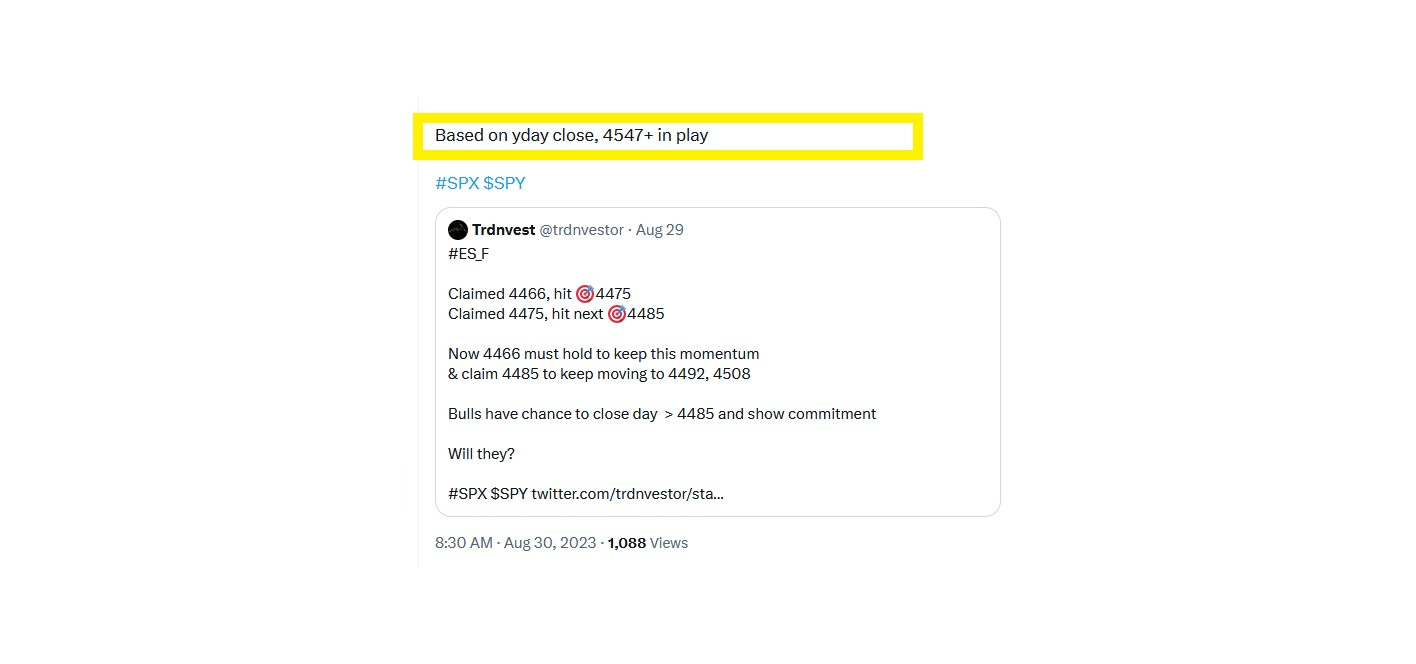

Last week started with cautious optimism for #ES_F, #NQ_F and #YM_F. Market held my support levels well and swiftly hit back test targets by Tuesday with quite bullish force. On Wed posted on X, 4547 upside target for #ES based on Tuesday closed, and lo & behold, this Friday’s peak hit precise 4547.75 & bears pushed it down just enough to wrap the week in green. #RTY turned to be quite bullish when it held 1854(1857 actual) on Sunday night & claimed 1875 on Monday clearing way to 1930 (1934 actual)

Here’s that Wednesday post about #ES:

USD / #DXY continued to be bullish for seventh straight week, despite one day close below by expected level of 103.190

As I embark on this newsletter-writing journey, I'll be exploring different formats to deliver my chart readings. The primary objective remains: identifying potential actionable levels to enhance your trading. Your feedback will be invaluable in this journey. Looking forward to it!

#ES_F / $SPX Futures: Bullish bit careful

Current Sentiment: The weekly view for E-mini S&P 500 Futures (#ES_F) is bullish, while the daily view advises caution. Friday's close seemed somewhat weak, but the weekly close maintained its bullish stance.

Bullish Confirmation: Bulls need to hold the 4515 level and promptly reclaim 4532 to confirm their momentum towards 4610

Key Support Levels: As long as the range between 4495 and 4472 holds, the potential target remains at 4610.

Bearish Scenario: A failure at 4508 could open the door to a test of 4472, and a subsequent failure at 4472 could shift the focus to 4445 or 4435.

Zoomed-out View: If bulls secure the 4485/4472 range and reclaim 4532, a substantial move to 4740 could be possible.

Key Levels: Keep a close watch on resistance at 4532, 4560, 4580, 4600, and 4615, and essential support at 4508, 4485, 4472, 4435, and 4414.

Red Flags: Be vigilant for potential market reversals on red days

Orange Flag: A close below 4407 signifies that the daily uptrend bias is in question.

1st Red Flag: A close below 4432suggests that the short-term weekly uptrend bias is in question.

2nd Red Flag: If the close falls below 4414, it indicates that the short-term weekly uptrend bias has been voided.

#NQ_F / #NDX Futures: Still bullish but some caution

Current Sentiment: The weekly outlook for Nasdaq Futures (#NQ_F) leans bullish, with a cautious daily sentiment. While Friday's close showed a minor weakness, the overall weekly stance remains bullish.

Bullish Confirmation: To affirm bullish momentum, it's crucial for bulls to hold the 15490 level and swiftly reclaim 15560. Then, the primary target remains the significant 15870+ zone.

Key Support Levels: As long as the support range between 15490 and 15455 holds, 15870 in play

Bearish Scenario: If 15455 support falters, it could lead to potential tests of 15340 or 15100.

Zoomed-out View: The path to new all-time highs is not out of reach. For this to materialize, it's crucial for the bulls to maintain control over 15490 or 15340 while successfully reclaiming 15560.

Key Levels: Keep a close watch on resistance levels at 15560, 15615, 15755, 15870, and 15950, as well as crucial support levels at 15455, 15340, 15155, 15050, and 14970.

Red Flags: Be vigilant for potential market reversals on red days

Orange Flag: A close below 15455 signifies that the daily uptrend bias is in question.

1st Red Flag: A close below 15355 suggests that the short-term weekly uptrend bias is in question.

2nd Red Flag: If the close falls below 14970, it indicates that the short-term weekly uptrend bias has been voided.

#YM_F / #DJI Futures: Green week in works

Current Sentiment: The weekly outlook for Dow Jones Industrial Average Futures (#YM_F) leans bullish, with a note of caution on the daily chart. The market successfully held the 34410 weekly support level and closed above the box.

Bullish Confirmation: To affirm the bullish momentum, it is essential for the bulls to maintain control over the 34805/34770 range and promptly reclaim 34975.

Key Support Levels: As long as the support range between 34805 and 34770 remains intact, there's potential for a back test of 35395 and beyond.

Bearish Scenario: A failure to hold the 34770 level could open the door to potential tests of 34620 or 34525.

Zoomed-out View: A bullish scenario for Dow Jones futures involves maintaining control over the 34805/34770 range and successfully reclaiming 34975 to keep 35595 a target.

Key Levels:

Resistance levels: 34895, 34975, 35190, 35395, and 35415

Support levels: 34805, 34770, 34620, 34525, and 34400

Red Flags: Be vigilant for potential market reversals on red days

Orange Flag: A close below 34770 may indicate that the daily uptrend bias is in question.

1st Red Flag: If the market closes below 34525, it suggests that the short-term weekly uptrend bias is in question.

2nd Red Flag: The market will raise significant concerns if it closes below 34400, indicating that the short-term weekly uptrend bias has been voided.

#RTY_F / #RUT Futures: Turned bullish

Current Sentiment: The weekly outlook for Russell 2000 Index Futures (#RTY_F) appears bullish, with a cautious daily sentiment. The market held firm above the weekly 1855 support level and successfully closed above 1885, dispelling bearish pressures observed during the week of August 21.

Bullish Confirmation: To sustain the bullish momentum, it is essential for the market to maintain levels around 1914/1908 and reclaim 1932.

Key Support Levels: As long as the support range between 1914 and 1908 remains unbroken, the path towards 1965/1977 remains open.

Bearish Scenario: A potential breach of the 1908 level could open the door to tests of 1895 or even 1875.

Zoomed-out View: In a broader context, a bullish scenario for Russell 2000 futures entails maintaining control over the 1914/1908 range and successfully reclaiming 1932, potentially targeting 2015.

Key Levels: Keep a close watch on resistance levels at 1940, 1965, 1977, 1995, and 2002, as well as vital support levels at 1914, 1908, 1895, 1890, and 1865.

Red Flags: Be vigilant for potential market reversals on red days

Orange Flag: A close below 1902 may signify a cautious stance on the daily uptrend bias.

1st Red Flag: If the market closes below 1889.6, it may suggest that the short-term weekly uptrend bias is in question.

2nd Red Flag: Significant concerns may arise if the market closes below 1856, voiding the short-term weekly uptrend bias.

In the ever-evolving market, traders should remain adaptable, closely monitor price movements, and implement effective risk management strategies. Trading inherently carries risks, so it's crucial to make informed decisions and utilize risk mitigation tools to protect your investments.

#DXY / $USD : Bulls still going strong

The US Dollar Index (#DXY $USD) has been on a remarkable bull run, charting its seventh consecutive green week and sealing its highest weekly close since March.

Remarkably, the momentum doesn't seem to be waning, with no visible signs of the USD taking a breather. Currently hovering near the next resistance zones of 104.500 and 104.640, a pullback might be on the horizon – an anticipation that has been on the cards for the past three weeks. However, a significant trend reversal isn't anticipated unless the week concludes in red below the 102.770 mark. Bears may find solace if there's a red day closure below 103. These dynamics in the USD market may contribute to the cautious bullish sentiment observed in other markets like #ES_F, #NQ_F, #YM_F and #RUT.

Note:

Across the FinTwit community, there's a buzz about September's historical reputation as a bearish month, with early weeks potentially marking the highs. While history occasionally echoes, there's never a guarantee. Instead of getting caught up in past patterns, my focus remains on the current price action and on those pivotal levels where a shift in bias might be imminent. Remember, the upcoming week is short due to the Labor Day holiday. But, as always, whether we experience low volume or wild volatility, I trust the levels identified to stand their ground. 😊

Have a successful trading week!

Disclaimer: This is NOT financial advice. I am NOT a financial advisor.