Weekly Charts Reading for 7/15- 7/19

Bulls: Rest, Rotate, or Run?

Thanks to everyone who clicks 'Like', 'Repost', or 'Restack' this newsletter.

Your encouragement means a lot and keeps me motivated!

Given the abundance of numbers in this newsletter, there's a chance I might make a typo. If you spot any errors, please give me a heads up. Thanks a bunch!

How’s last week?

#ES_F

New ATH on Friday: 5708.25, hitting my first monthly bullish target of 5705

Last week saw continued bullish move despite Thursday's quick flush after CPI

PPI bulls held key 5630 support after dipping to 5622, reclaimed, and made new ATH

#ES held better than #NQ during Thursday's flush

#NQ_F

Continued bullish move, hitting monthly targets of 20705 and 20820 on Wednesday

Thursday's flush sliced through multiple key support levels

By Friday morning, before PPI, bulls were under 20445, showing weakness (noted this pre-PPI)

After PPI, flushed to 20335 (level posted before PPI), then bulls quickly reclaimed 20370

Friday back tested key 20725 level from Wednesday but couldn't reclaim it, closing at 20539.75

#RTY

Most impressive move last week

Was coiling in a tight range, expected a forceful breakout

Had a bullish bias on #RTY; it delivered

Wednesday's close near 2070 prompted post on X that #RTY bulls seemed different this time

CPI on Thursday boosted the move

Despite the great move, #RTY is far from making a new ATH (last high in Nov 2021)

#YM

Continued in a tight range, needed to close above 40K or at least 39860 to show bullish commitment

Monday/Tuesday saw upside moves sold off, but key support levels held

Quick bullish play on Monday worked nicely

Bulls claimed 39860 and 40K levels on Wednesday and as expected, continued bullish march Thursday and Friday, making new ATH at 40572

#DXY

If you've followed my newsletter, you'd notice my accurate tracking of #DXY moves

Bears continued to move #DXY down, inverse correlation with #RTY still holding

Bears need to close the week below 103.880 to bring March lows into play

Market provided good bi-directional trading opportunities for active traders

Read here how I use this Weekly Newsletter in my daily trading

Disclaimer: This is NOT financial advice. I am NOT a financial advisor.

Quick update: It seems reaching 500 subscribers might take a bit longer than I hoped. But I'm not giving up just yet. I'll keep publishing, though I might take more breaks along the way. 😀

Big thanks to all of you who've been cheering me on. Your support means a lot!

Thanks, all!

Week Ahead (7/15 – 7/19)

If Friday afternoon's weakness continues after Sunday open or spills into Monday morning, bulls will need to defend their levels as identified below.

If bulls fail to defend these levels early on, a deeper pullback is likely, especially as #ES and #NQ are close to key support levels.

Expecting this week to continue offering bi-directional trading opportunities.

Quick Summary

#ES: As long as 5660 or 5656 holds or is reclaimed, 5687/5705/5722/5740 are in play. If 5622 fails, look for 5610/5590/5560.

#NQ: As long as 20525 or 20475 holds or is reclaimed, 20735/20890/21050+ are in play. If 20335 fails, look for 20240/20100/20045.

#RTY: As long as 2165/2158 holds, 2181/2194/2210/2222+ are in play.

#YM: As long as 40305/40155 holds, 40510/40650/40700 are in play.

As #DXY approaches key 103.880 support, I’ll be watching its reaction to give clues about how #RTY might behave.

Note: I'm not an expert in geopolitics or macro/microeconomic analysis, so I won't be commenting on recent political events in the US or around the world. Thanks for understanding!

Note about levels above ATH

Upside targets are estimated without left-side confirmation on the chart, utilizing a combination of Fibonacci and trend lines across multiple time frames. Feel free to reach out if these levels prove effective; otherwise, your understanding is appreciated.

These levels are subject to refinement as prices evolve throughout the days.

In the event of new highs, prioritizing profit-taking based on risk-to-reward multiples is recommended, rather than waiting for specific target levels to be reached.

Feel free to scroll down to the end of the report to get a rundown on some of the terms I'm throwing around, like "hold," "claim," and “fail”

Events Calendar:

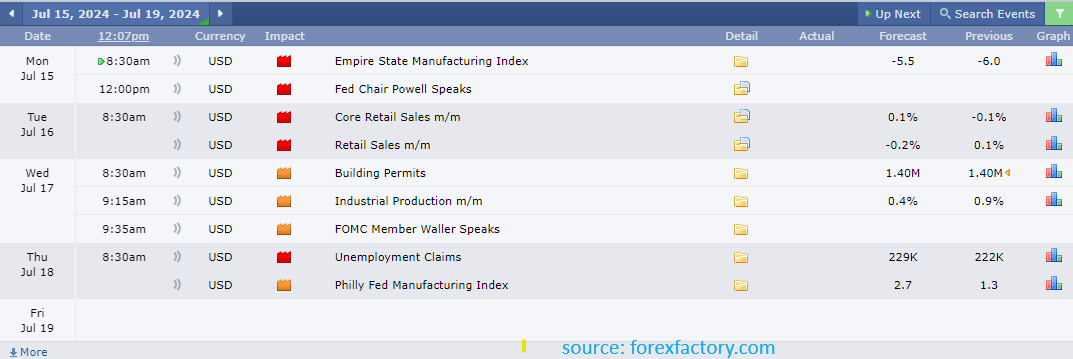

Next week's events calendar is relatively light on economic reports. Key reports include Retail Sales on Tuesday morning and Unemployment Claims on Thursday. Surprisingly, there are no reports on Friday, but Monday starts with the Empire State Manufacturing Index.

FOMC Chair Powell speaks on Monday at noon, and Waller speaks on Wednesday morning, both of which could add to market volatility.

Though it's a quiet week for economic reports, earnings season will pick up the slack. Key banks and financial institutions like GS, BAC, MS, and AXP, as well as widely followed companies like NFLX, TSM, and ASML, will report their earnings later in the week.

#ES_F / $SPX Futures:

📈 Weekly: caution 🐂 📊 Daily: caution 🐂

Analysis:

Despite Friday afternoon's quick drop after setting a new ATH, the week closed in solid green.

Weekly and daily bias remains bullish.

Adding caution due to the sharp pullback on Friday after hitting my first monthly target of 5705 (5708.25 high).

#NQ shows weakness; if it continues, it may spill into #ES too.

Hence, bullish bias with caution.

Above 5635, bulls maintain momentum.

Below 5622, bulls enter the pain zone.

Downside:

Key support levels: 5644/30, 5590, 5564 and 5536/32

Ideally, bulls should defend 5644/5630 or at last 5622 to prevent a deeper drawdown.

Upside:

Key resistance levels: 5680/87, 5705, 5712/22, and 5740

Yearly View:

🐂 Bullish: As long 4420/4350 holds 5615/6110+ in focus (first target hit Jul 5th)

🐻 Bearish: Monthly trend will dictate the bearish stance.

Monthly Viewpoint:

🐂 Bullish: as long 5435 or at last 5380 holds/reclaimed, 5705/5800 in play (first monthly target of 5705 hit)

🐻 Bearish: will determine when weekly trend turns bearish

Weekly Perspective:

🐂 Bullish: If 5660 or 5656 holds, 5687/95*/5705*/22/40*+ in play

🐻 Bearish: If 5656 fails, 5644*/35/30/22*/10*- in play.

Level by Level Bullish Play (on Daily):

If 5660 or 5656 holds, 5670/80/87* in play

If 5687 claimed, 5695/5705*/12* next

If 5612 claimed, 5722*/31/40* in play

If 5740 claimed, 5747/60/75* next

If 5775 claimed, 5793/5805* in play

Level by Level Bearish Play (on Daily):

If 5656 fails, 5644/5635/30* in play

If 5630 fails, 5622/18/10* next

If 5610 fails, 5596/90*/85* in play

If 5585 fails, 5574/64*/60* next

If 5560 fails, 5551/43/35* in play

If 5535 fails, 5523/11*/05* next

Zoomed-out View:

🐂 Bullish: If 5500 holds or reclaimed (on weekly), 5705/5800 in play

🐻 Bearish: if 5622 fails to hold, 5590/5560/36/5511*- in play

🔑 Key Levels:

Resistance: 5670, 5680*, 5687, 5695*, 5705, 5712*, 5722, 5731, 5740*, 5747, 5760, 5775*, 5785, 5793, 5805*, 5813, 5825*, 5850*

Support: 5660*/56, 5644*, 5635, 5630*/27, 5622*/18*, 5610*, 5606/03, 5596, 5590*/85*, 5577, 5569*, 5564/60*, 5554, 5545, 5536*/32,5523/19, 5515*/11*, 5505/00*, 5495*/90*, 5480*/73, 5470/65, 5452*, 5445*, 5535, 5416, 5400*

Possible Trade Plans:

Besides level by level plays detailed above, follow are possible additional long and short trade opportunities to consider.

Long Trades:

*If price holds 5644 or drops below 5644 say 5638 & quickly claims 5644 on lower time frame, then consider long trade with SL below 5644 and 5656*, 5660, 5670 and 5680* as targets.

If price holds 5630 or drops below 5630 say 5627 & quickly claims 5630 on lower time frame, then consider long trade with SL below 5630 and 5645*, 5656, 5660 and 5670* as targets.

*If price holds 5590 or drops below 5590 say 5588 & quickly claims 5591 on lower time frame, then consider long trade with SL below 5590 and 5598*, 5607, 5613* and 5619 as targets.

If price holds 5585 or drops below 5585 say 5582 & quickly claims 5588 on lower time frame, then consider long trade with SL below 5585 and 5596*, 5607 and 5615* as targets.

*If price holds 5564 or drops below 5564 say 5560 & quickly claims 5564 on lower time frame, then consider long trade with SL below 5560 and 5574, 5582*, 5588 and 5593* as targets.

*If price holds 5560 or drops below 5560 say 5557 & quickly claims 5564 on lower time frame, then consider long trade with SL below 5564 and 5574, 5582*, 5588 and 5593* as targets.

*If price holds 5536 or drops below 5536 say 5532 & quickly claims 5536 on lower time frame, then consider long trade with SL below 5536 and 5545*, 5554 and 5564* as targets.

*If price holds 5519 and quickly claims 5523 on lower time frame, then consider long trade with SL below 5523 and 5536*, 5545, 5560* as targets.

Short Trades:

On lower time frames if rejection of 5680/87, 5705, 5712/22, or 5740 appears, consider short trades with SL above these levels and with next 2nd or 3rd support levels below as targets.

Red Flags:

Keep an eye out for potential signs of a bearish reversal on red days:

Moving flag levels up aggressively for early detection of trend change

Orange Flag: Close below 5622 questions the daily uptrend.

1st Red Flag: Close below 5560 suggests a potential shift in the short-term weekly uptrend bias.

2nd Red Flag: Close below 5500 indicates possible voiding of the short-term weekly uptrend bias.

#NQ_F / #NDX Futures:

📈 Weekly: cautious 🐂 📊 Daily: Cautious 🐂

Analysis:

Week closed slightly red but held last week's key supports at 20435/20470.

Weekly and daily bias remains bullish.

Adding caution due to price being close to weekly support and weak recovery after Thursday's big red day.

Upside:

Above 20435, bulls keep momentum.

Key resistance levels: 20635, 20735, 20850/20890, and 21045.

Daily green close above 21005, or at least 20975, brings 21630 on the radar.

Downside:

Below 20370, bulls enter the pain zone.

Key support levels: 20400*, 20240/20215, 19970/19945*, 19750/19725*.

Ideally, bulls should defend 20400 or at least 20370 to prevent a deeper drawdown.

Deeper pullback scenario:

In a rapid, deeper multi-day flush, support levels are 19970/19945, 19750/19700, 19600, 19500, and 19025 where bulls likely to bid

Bulls need to defend 19970/945 in any deeper pullback.

Scenario:

If 20335 fails to hold before making a new ATH or claiming 20735, expect a quick flush to 19200 and then 19970/19945/19750. Bulls need to defend 19970/19945 on the daily chart.

Stick to trading level by level as usual.

Yearly View:

🐂 Bullish: As long 14265/14140 holds 20320/22640 in play (hit 20320 on June 20th)

🐻 Bearish: will determine when monthly trend turns bearish

Monthly Viewpoint:

🐂 Bullish Goal: As long 19245 holds or reclaimed, 20705*/820* in play (hit all monthly targets)

🐻 Bearish Goal: will determine when weekly trend turns bearish

Weekly Perspective:

🐂 Bullish: If 20525 or 20475 holds or reclaimed, 20735*/850/890*/975/21045*+ in play

🐻 Bearish: If 20475 fails, 20435*/370*/240/215/19970*- in play

Level by Level Bullish Play (on Daily):

If 20525 or 20475 holds, 20635/20680/735* in play

If 20735 claimed, 20850/890*/920* next

If 20920 claimed, 20975*/21005/045*/095* in play

If 21045 claimed, 21160*/190*/240/330* next

Level by Level Bearish Play (on Daily):

If 20475 fails, 20435*/20400/370* in play

If 20370 fails, 20240/215*/200 next

If 20200 fails, 20065/19970/940* in play

1f 19905 fails, 19750/725*/700* next

Zoomed-out View:

🐂 Bullish: as long 20240/200 holds or reclaimed, 20850/890/21045+ in play

🐻 Bearish: if 20200 fails to hold, 19970*/905*/19750*- in play

🔑 Key Levels:

Resistance: 20565, 20595, 20635*, 20680, 20735*, 20790, 20820, 20850/890*, 20920, 20975*, 21005, 21045, 21095*, 21125, 21160/190*, 21240, 21330*, 21375, 21410, 21450*, 21490, 21515, 21550*, 21590, 21630*, 21680*

Support: 20525*, 20475, 20435*, 20400/370*, 20335, 20270, 20240, 20215*/200*, 20125, 20065*, 20015, 19970/945*, 19905*, 19880, 19840/810*, 19750*/725*, 19700, 19685*, 19625/00, 19545, 19500*

Possible Trade Plans:

Besides level by level plays detailed above, follow are possible additional long and short trade opportunities to consider.

Long Trades:

* If price holds 20435 or drops below 20435 say 20415 & quickly claims 20435 on lower time frame, then consider long trade with SL below 20435 and 20475, 20525, 20565, and 20635* as targets.

If price holds 20370 or drops below 20370 say 20360 & quickly claims 20370 on lower time frame, then consider long trade with SL below 20370 and 20415, 20445, 20490 and 20525 as targets.

If price holds 20240 or drops below 20240 say 20230 & quickly claims 20245 on lower time frame, then consider long trade with SL below 20240 and 20290, 20330 and 20370 as targets.

*If price holds 20215 or drops below 20215 say 20205 & quickly claims 20220 on lower time frame, then consider long trade with SL below 20215 and 20240, 20290, 20330 and 20370 as targets.

*If price holds 19970 or drops below 19970 say 19960 & quickly claims 19970 on lower time frame, then consider long trade with SL below 19970 and 20015, 20065 and 20125 as targets.

*If price holds 19945 or drops below 19945 say 19920 & quickly claims 19945 on lower time frame, then consider long trade with SL below 19945 and 19970, 20015 and 20065 as targets.

*If price holds 19905 or drops below 19905 say 19875 & quickly claims 19905 on lower time frame, then consider long trade with SL below 19905 and 19945 19970, 20015 and 20065 as targets.

*If price holds 19750 or drops below 19750 say 19730 & quickly claims 19750 on lower time frame, then consider long trade with SL below 19750 and 19810, 19840 and 19880 as targets.

Short Trades:

On lower time frames if rejection of 20635, 20735, 20850/890*, 21045 appears, consider short trades with SL above these levels and with next 2nd or 3rd support levels below as targets.

Red Flags:

Keep an eye out for potential signs of a bearish reversal on red days:

Moving flag levels up aggressively for early detection of trend change

Orange Flag: Close below 20375 questions the daily uptrend.

1st Red Flag: Close below 20200 on a red day may suggest a shift in the short-term weekly uptrend bias.

2nd Red Flag: Close below 19905 on a red day may indicate potential voiding of the short-term weekly uptrend bias.

#RTY_F / #RUT Futures:

📈 Weekly: Cautious 🐂📊 Daily: Cautious 🐂

Analysis:

As expected, the week closed strong green, keeping the weekly and daily bias bullish.

Couldn't claim 2181 or even 2169 after testing, hence adding caution to the bullish bias.

#DXY continues its path down, approaching key 103.880 where a bounce may occur.

If #DXY bounces, #RTY likely to see a pullback due to their inverse correlation.

Bulls must defend 2130, or at least 2110/2105, to continue last week's green streak.

Claiming 2181 gives bulls added support to continue the move up.

Note: While the other three indices made new ATHs, #RTY is still far from 2021 highs. If it intends to catch up, the bulls likely need to move quickly.

Above 2049, bulls keep momentum.

Below 2044, bulls enter the pain zone.

Yearly View:

🐂 Bullish: Holding above 1867 targets 2247/2461/2575+.

🐻 Bearish: Will determine when monthly trend turns bearish

Monthly Viewpoint:

🐂 Bullish: As long 2053/2032 holds or reclaimed 2210/2247/2300+ in play (back in play)

🐻 Bearish: As long bears hold 2058 or at least 2036, 1982/1960 in play (invalidated)

Weekly Perspective:

🐂 Bullish: If 2165/2158 holds and 2181 reclaimed, 2194/2221*/32/47* in play

🐻 Bearish: If 2158 fails, 2149/44*/30/26*/10*- in play

Level by Level Bullish Play (on Daily):

If 2165 or 2158 holds, 2175/81 in play

If 2181 claimed, 2194*/98 next

If 2194 claimed, 2210/2221* in play

If 2221 claimed, 2232/47* next

If 2247 claimed, 2251.5/2260 in play

Level by Level Bearish Play (on Daily):

If 2158 fails, 2149/44* in play

If 2144 fails, 2140/30*/26* next

If 2126 fails, 2110*/05* in play

If 2105 fails, 2085/80* next

If 2080 fails, 2069*/65* in play

Zoomed-out View:

🐂 Bullish: as long 2110/05 holds, 2247/2300 in play

🐻 Bearish: if 2105 fails, 2069*/65*/52 in play

🔑 Key Levels:

Resistance: 2169, 2175, 2181*, 2194/98*, 2210, 2221*, 2232, 2247*, 2251.5, 2260, 2274.2*, 2282.5*, 2289

Support: 2165, 2158*, 2149/44*, 2140, 2130*/26*, 2119/14, 2110*/05*, 2098, 2085, 2080*, 2069*/65*, 2052/48*, 2038*, 2032, 2025.7*

Red Flags:

Keep an eye out for potential signs of a bearish reversal on red days:

Moving flag levels up aggressively for early detection of trend change

Orange Flag: A close below 2144 daily uptrend is in question

1st Red Flag: A week close below 2105 on a red day may suggest that the short-term weekly uptrend bias is in question.

2nd Red Flag: If the market closes below 2065 on a red day, indicating potential voiding of the short-term weekly uptrend bias.

Note about Terminology:

In my weekly reports and X (Twitter) posts, I often refer to terms like "must hold," "claim," or "fail." Here's a quick explanation of what these terms mean:

For intraday analysis: I consider the 15-minute or 1-hour candle close.

For trades spanning overnight to two days: I focus on the 4-hour candle close.

For a weekly or longer-term outlook: I rely on the daily candle close.

close above: claimed / close below: failed

These references are also available in the pinned thread on my X profile. I strongly recommend reading this thread for a deeper understanding of my chart analysis. If I get lot more subscribers and engagement, I plan to elaborate on my methodology in a separate Substack post in the future, the pinned thread on my X profile offers valuable insights for now.

Read this thread on X to learn about my chart reading method and examples of hold/fail/claim/reject setups for trade execution

Curious about your trading experiences. Share your trading moves inspired by this newsletter – the wins, the almost-wins, and the lessons learned. Drop your insights in the comments below or over on X (formerly Twitter). Let's learn and grow together!

Be nimble and adjust your strategies according to market conditions and the mentioned support and resistance levels. Monitor flag levels for early signs of bias shifts. If you're not following me on X @trdnvestor , consider doing so for daily updates.

Wish you a great trading week!

Disclaimer: This is NOT financial advice. I am NOT a financial advisor.