Weekly Charts Reading for 7/1- 7/5

Breaking Free: Retreat or Advance?

Thanks to everyone who clicks 'Like', 'Repost', or 'Restack' this newsletter.

Your encouragement means a lot and keeps me motivated!

How’s last week?

#ES

Friday's attempt to make a new ATH fizzled, closing the week slightly in the red. However, Monthly and Quarterly Candles closed solidly green.

Friday's move to 5585 completed a back test of the 5575/80 support levels from June 20th, where the slide to last week's low started.

Upside targets were hit level by level, but the downside target after Monday's close below 5518 did not reach 5303. Instead, #ES found support at 5510, which held and was tested several times last week.

#NQ

Similar to #ES, Friday's attempt to make a new ATH fizzled, closing the week slightly in the red. Monthly and Quarterly Candles closed solidly green.

Friday's move to 20275 completed a back test of the 20275/85 support levels from June 20th, where the slide to last week's low started.

Upside targets were hit level by level, but the downside target after Monday's close below 19760 did not reach 19700. Instead, #NQ found support at 19725 and recovered nicely.

On June 20th, #NQ hit my first yearly target of 20320 (20371 high). These targets were shared in the January 2024 newsletter. As always, with the level, this would invalidate the play.

#RTY

Even in Wednesday's quick flush, bulls held the key 2033 level, and the week closed in green. However, the Monthly candle was slightly red, and the quarter ended in red.

As I wrote last week, "If bulls can defend 2025, the low for the month is in." Last week's low was 2026.5.

#YM

The most difficult price action to nail among the four index futures. The week closed slightly in the red despite an initial attempt to complete a back test of 40130 (39999 high).

Month closed in good green and quarter slightly red. Keeping bullish hopes alive.

#DXY

Bulls showed some exhaustion but still managed to close the week green. Bears lacked strength but may gain some soon.

Despite a range bound, the market provided plenty of opportunities for bi-directional trading for active traders.

An interesting observation: most short weeks this year saw good red days for #ES and #NQ. Next week is a short week due to the July 4th Independence Day holiday.

Read here how I use this Weekly Newsletter in my daily trading

Given the abundance of numbers in this newsletter, there's a chance I might make a typo. If you spot any errors, please give me a heads up. Thanks a bunch!

Disclaimer: This is NOT financial advice. I am NOT a financial advisor.

Quick update: It seems reaching 500 subscribers might take a bit longer than I hoped. But I'm not giving up just yet. I'll keep publishing, though I might take more breaks along the way. 😀

Big thanks to all of you who've been cheering me on. Your support means a lot!

Thanks, all!

Week Ahead (7/1 – 7/5)

Next week starts a new month. Ideally, a first down then up move would support bullish continuation. This doesn't guarantee it will happen, but it's typically more bullish (ever heard of red to green?).

The last couple of weeks saw narrow range trading, coiling up for bigger, faster moves with clear direction.

Despite being a short week, it's packed with important economic reports and J Powell speaking on Tuesday morning and FOMC minutes Wednesday 2pm, which might provide the catalyst for fast action.

Expect more volatility and bi-directional trading opportunities this week.

As mentioned before, #DXY bulls paused last week. If #DXY retreats further, #RTY might see increased bullish commitment.

For a bullish #YM play, I want to see 39460/445 holding and 39600 claimed first to target 39850, 40000, and 40130+.

As always, trade level to level with the right position size and stop loss.

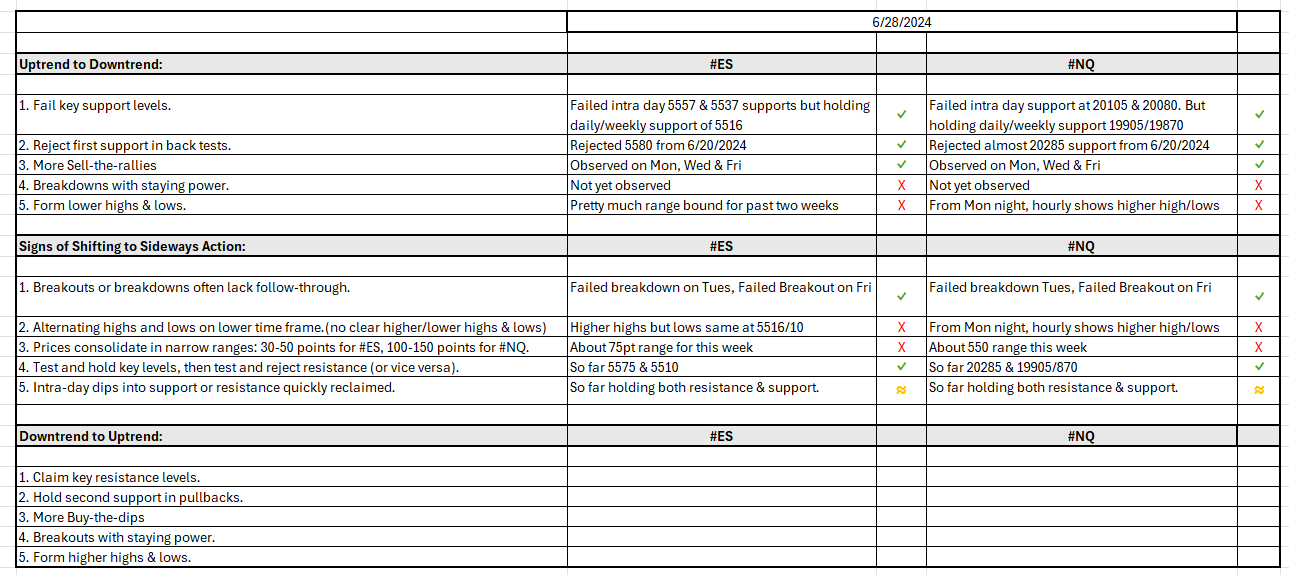

Here's my cheat sheet on trend changes and what I observed for #ES & #NQ.

FWIW...

Note about levels above ATH

Upside targets are estimated without left-side confirmation on the chart, utilizing a combination of Fibonacci and trend lines across multiple time frames. Feel free to reach out if these levels prove effective; otherwise, your understanding is appreciated.

These levels are subject to refinement as prices evolve throughout the days.

In the event of new highs, prioritizing profit-taking based on risk-to-reward multiples is recommended, rather than waiting for specific target levels to be reached.

Feel free to scroll down to the end of the report to get a rundown on some of the terms I'm throwing around, like "hold," "claim," and “fail”

Events Calendar:

Next week is packed with economic reports from Monday to Friday, except for the July 4th holiday. Monday starts with PMI, followed by JOLTS on Tuesday, ADP Employment Change, Unemployment Claims, and Services PMI on Wednesday. The week ends with NFP Employment Change and the Unemployment Rate on Friday.

The highlight will be J Powell's talk on Tuesday morning and the FOMC minutes release on Wednesday at 2 pm. These events should give the market plenty of reasons to be volatile and break the tight range. Especially after Wednesday's FOMC minutes, Friday may see bigger moves. Will the market follow through?

#ES_F / $SPX Futures:

📈 Weekly: caution 🐻 📊 Daily: caution 🐻

Analysis:

First somewhat red week after three green weeks, shifting weekly bias to bearish.

Adding caution as it's still holding above key 5500/5490 support levels.

Since it attempted to close green above 5563 on Friday and failed, keeping daily bias to bearish.

Adding caution to the bearish bias as it's still above last week's must-hold levels of 5525 & 5518.

If a green day closes above 5568 or at least 5563, daily bias may turn bullish.

Ideally, if a green day close above 5563 happens after testing and bouncing from 5500/5490, then the weekly bias may change to bullish too.

Last week, every day tested the 5516 level & bulls defended it despite dipping to 5510, recovering 5516 quickly.

If 5515 fails now, 5510 may not get bought quickly; instead, 5500/5490 are likely to be tested or even skipped in a quick flush scenario.

If bulls hold 5530/23 next week & claim 5563/68, #ES is likely to continue moving up to 5603/15+.

Strong rejection of 5575/80 levels on Friday suggests two possibilities:

Sideways action continues in the 5568-5500/5490 range.

Fails to hold 5500/5490 and continues moving down, bringing 5435 & 5334* on the radar.

On the downside, four key support levels: 5454/5435, 5380*, 5334*, and 5300. Ideally, bulls defend 5380 or at least 5334 to prevent a deeper drawdown.

On the upside, four key resistance levels: 5551, 5563*, 5568*, and 5576. Ideally, bears defend 5563 to prevent a spike.

In short, #ES needs a close above 5568 or at least 5563 for upside momentum and a close below 5490 or at least 5495 for downside.

Above 5515, bulls keep momentum; below 5490, bulls enter the pain zone.

On a monthly view, ideally, bulls hold 5435 & bounce from there in a pullback. In case of a deeper pullback, bulls must hold 5380 or at least 5334 or reclaim it quickly from 5300 or above to keep monthly bullish momentum.

A daily close above 5585 brings 5656/5680 on the radar.

Last week's price action was within the previous week's range, so most level-by-level plays remain the same with some minor fine-tuning.

Yearly View:

🐂 Bullish: Hold above 4420/4350 for focus on 5615/6110+.

🐻 Bearish: Monthly trend will dictate the bearish stance.

Monthly Viewpoint:

🐂 Bullish Goal: as long 5435 or at last 5380 holds/reclaimed, 5705/5800 in play

🐻 Bearish Goal: will determine when weekly trend turns bearish

Weekly Perspective:

🐂 Bullish: If 5523/15 holds, 5551/63*/68*/76/5603+ in play

🐻 Bearish: If 5515 fails, 5500/5445/35*/5398- in play.

Level by Level Bullish Play (on Daily):

If 5530 or 5523/15 holds, 5551/57/63* in play

If 5563 claimed, 68*/76*/85 next

If 5576 claimed, 5595/5603/5615* next

If 5615 claimed, 5642/5650*/5680* in play

Level by Level Bearish Play (on Daily):

If 5515 fails, 5500/5495/90* in play

If 5490 fails, 5452/45/35* next

If 5435 fails, 5415/5398 in play

If 5398 fails, 5385/80*/5370* next

Zoomed-out View:

🐂 Bullish: if 5300 holds or reclaimed (on weekly), 5705/5800 in play

🐻 Bearish: if 5300 fails to hold, 5269/5250*/45/17*- in play

🔑 Key Levels:

Resistance: 5537, 5547/51*, 5563*, 5568*, 5576*, 5585, 5595, 5603*, 5610, 5615*, 5622, 5630, 5642*, 5650*, 5665, 5680

Support: 5530, 5523/19*, 5515*/10*, 5503/00*, 5495*/90*, 5470/65, 5454*, 5445/35*, 5415, 5398*, 5385/80*, 5370*, 5347, 5334*

Possible Trade Plans:

Besides level by level plays detailed above, follow are possible additional long and short trade opportunities to consider.

Long Trades:

*If price holds 5530 or drops below 5530 say 5527 & quickly claims 5530 on lower time frame, then consider long trade with SL below 5530 and 5537*, 5547, 5551* and 5563/5568 as targets.

If price holds 5519 or drops below 5519 say 5516 & quickly claims 5519 on lower time frame, then consider long trade with SL below 5519 and 5527*, 5537, 5547* and 5551/5563 as targets.

*If price holds 5500 or drops below 5500 say 5497/95 & quickly claims 5500 on lower time frame, then consider long trade with SL below 5500 and 5510, 5518*, 5523 and 5530* as targets.

*If price holds 5495 or drops below 5495 say 5492/90 & quickly claims 5495 on lower time frame, then consider long trade with SL below 5495 and 5503*, 5509, 5518* as targets.

*If price holds 5454 or drops below 5454 say 5452/48 & quickly claims 5454 on lower time frame, then consider long trade with SL below 5452 and 5465*, 5472, 5480* as targets.

*If price holds 5435 and quickly claims 5438 on lower time frame, then consider long trade with SL below 5438 and 5447*, 5454, 5465* as targets.

If price holds 5409 or drops below 5409 say 5406 & quickly claims 5409 on lower time frame, then consider long trade with SL below 5409 and 5417*, 5422, 5435* as targets.

If price holds 5398 and quickly claims 5406 on lower time frame, then consider long trade with SL below 5400 and 5415*, 5422, 5435* as targets.

Short Trades:

On lower time frames if rejection of 5551/63/68/76 appears, consider short trades with SL above these levels and with next 2nd or 3rd support levels below as targets.

Red Flags:

Keep an eye out for potential signs of a bearish reversal on red days:

As price didn't move significantly, keeping flag levels unchanged

Orange Flag: Close below 5515 questions the daily uptrend.

1st Red Flag: Close below 5435 suggests a potential shift in the short-term weekly uptrend bias.

2nd Red Flag: Close below 5338 indicates possible voiding of the short-term weekly uptrend bias.

#NQ_F / #NDX Futures:

📈 Weekly: cautious 🐻 📊 Daily: Cautious 🐻

Analysis:

Slight red week after three strong green weeks, changing weekly bias to bearish.

Adding caution to this weekly bearish bias because:

Still holding last week's support of 19955 & 19905.

Still holding Thursday's low.

Friday's move to 20275 completed the back test of June 20th support, where the slide to last week's low started.

Strong rejection and failure to close above 20285 or even 20080 keeps daily bias bearish.

Adding caution to the daily bearish bias as it is still holding Thursday's low.

A red day close below 19870 removes caution from the daily bearish bias, and a red day close below 19725 removes it from the weekly bias.

To see bull commitment, need to see 19955 or at least 19930 hold and quickly claim 20085 on Sunday/Monday.

Bulls are weak below 20275.

Bears are weak above 19890.

Above 19930, bulls keep momentum.

Below 19870, bulls enter the pain zone.

A daily green close above 20275 shows bulls are confident and in control, bringing 20705 on the radar.

A daily red close below 19725 shows bears are stronger and could lead to a quick flush.

If 19930 holds or is reclaimed, 20085/20105/20150 are back test targets.

In a rapid flush scenario, key support levels are 19600, 19500, 19245/230, 19025*, and 18940, where bulls are likely to bid.

Bulls need to defend 19245/230/19025 in any deeper pullback.

Stick to trading level by level as usual.

Yearly View:

🐂 Bullish: As long 14265/14140 holds 20320/22640 in play (hit 20320 on June 20th)

🐻 Bearish: will determine when monthly trend turns bearish

Monthly Viewpoint:

🐂 Bullish Goal: as long 19245 holds or reclaimed, 20580/615*/705*/820* in play

🐻 Bearish Goal: will determine when weekly trend turns bearish

Weekly Perspective:

🐂 Bullish: If 19955 or 19930 holds & 20085 reclaimed, 20210*/275/345*+ in play

🐻 Bearish: If 19870 fails, 19725/600/500/400*/245*- in play

Level by Level Bullish Play (on Daily):

If 19955 or 19930 holds, 20015/20085/20115 in play

If 20115 claimed, 20210/20275/85* next

If 20285 claimed, 20345*/375/400*/430* in play

If 20430 claimed, 20495/20515 next

Level by Level Bearish Play (on Daily):

If 19870 fails, 19755/19725* in play

If 19725 fails, 19685/625/600*/500* next

If 19500 fails, 19435/400*/375* in play

If 19375 fails, 19245*/230*/190* next

Zoomed-out View:

🐂 Bullish: as long 19870 holds or reclaimed, 20345/400/615+ in play

🐻 Bearish: if 19870 fails to hold, 19725*/435*/375*- in play

🔑 Key Levels:

Resistance: 20015, 20075/85*, 20115*, 20150*, 20175, 20210, 20245, 20275, 20310/345*, 20375, 20400*, 20430, 20465, 20495, 20515*, 20580, 20620, 20715*, 20970, 21680*, 21220*

Support: 19955/30*, 19905/19875*, 19830, 19790, 19740/25*, 19700, 19685*, 19625/00, 19545, 19500*, 19435*/400*, 19375*, 19285, 19245/230*, 19190*, 19100/025*, 18975/940*, 18480*

Possible Trade Plans:

Besides level by level plays detailed above, follow are possible additional long and short trade opportunities to consider.

Long Trades:

If price holds 19955 or drops below 19955 say 19945 & quickly claims 19955 on lower time frame, then consider long trade with SL below 19955 and 20040, 20080, 20118, 20175/200 as targets.

* If price holds 19930 or drops below 19930 say 19915 & quickly claims 19930 on lower time frame, then consider long trade with SL below 19930 and 19965, 20015, 20040, and 20085* as targets.

If price holds 19870 or drops below 19875 say 19855 & quickly claims 19875 on lower time frame, then consider long trade with SL below 19875 and 19930, 19955, 20015 and 20070 as targets.

*If price holds 19725 or drops below 19725 say 19700 & quickly claims 19740 on lower time frame, then consider long trade with SL below 19725 and 19790, 19815 and 19870 as targets.

If price holds 19620 or drops below 19620 say 19600 & quickly claims 19630 on lower time frame, then consider long trade with SL below 19620 and 19685, 19760 and 19795 as targets.

*If price holds 19435 or drops below 19435 say 19400 & quickly claims 19435 on lower time frame, then consider long trade with SL below 19435 and 19500, 19555 and 19600 as targets.

*If price holds 19245 or drops below 19245 say 19220 & quickly claims 19245 on lower time frame, then consider long trade with SL below 19245 and 19285, 19310 and 19375 as targets.

*If price holds 19025 or drops below 19025 say 18995 & quickly claims 19025 on lower time frame, then consider long trade with SL below 1925 and 19100, 19190 and 19230 as targets.

Short Trades:

On lower time frames if rejection of 20085, 20175, 20275, 20345 appears, consider short trades with SL above these levels and with next 2nd or 3rd support levels below as targets.

Red Flags:

Keep an eye out for potential signs of a bearish reversal on red days:

Moving flag levels up than usual for early detection of trend change

Orange Flag: Close below 19870 questions the daily uptrend.

1st Red Flag: Close below 19500 on a red day may suggest a shift in the short-term weekly uptrend bias.

2nd Red Flag: Close below 18940 on a red day may indicate potential voiding of the short-term weekly uptrend bias.

#RTY_F / #RUT Futures:

📈 Weekly: Cautious 🐂📊 Daily: Cautious 🐂

Analysis:

Week closed in green, keeping weekly and daily bias bullish.

Adding caution to the bullish bias since it couldn't claim 2085 after testing it; need a green day close above 2085.

Adding caution also because #DXY closed the week in green, although it pulled back from resistance levels. USD bulls seem taking a break, but bears aren't strong.

If #DXY and #RTY inverse correlation continues, #RTY bulls might struggle until #DXY closes below at least 105 on the weekly.

Once a green day closes above 2085 and the low of that day holds, 2117/19+ comes into play.

Bulls need to defend 2051 or, in case of a deep pullback, 2038 to keep the monthly bullish bias in play.

#RTY has been in a tight range for months, coiling for bigger, faster moves likely if daily and weekly close above 2106.

Above 2051, bulls keep momentum.

Below 2038, bulls enter the pain zone.

Since the daily green close above 2060.5, bulls are confident but need a close above 2085 to see commitment.

Yearly View:

🐂 Bullish: Holding above 1867 targets 2247/2461/2575+.

🐻 Bearish: Will determine when monthly trend turns bearish

Monthly Viewpoint:

🐂 Bullish: As long 2053/2032 holds or reclaimed 2210/2247/2300+ in play (back in play)

🐻 Bearish: As long bears hold 2058 or at least 2036, 1982/1960 in play (invalidated)

Weekly Perspective:

🐂 Bullish: If 2066/2061/58 holds and 2085 reclaimed, 2101/06*/2114*+ in play

🐻 Bearish: If 2058 fails, 2051/47/38*- in play

Level by Level Bullish Play (on Daily):

If 2066/2061/58 holds, 2074/2080/2085* in play

If 2085 claimed, 2095/2101*/2106* next

If 2106 claimed, 2111/2114*/2119 in play

If 2114 claimed, 2124/2130* next

If 2130 claimed, 2141.5/2150.5* in play

Level by Level Bearish Play (on Daily):

If 2058 fails, 2051/47 in play

If 2047 fails, 2038*/2032* next

If 2032 fails, 2026/2019* in play

If 2019 fails, 2015/2006* next

If 2006 fails, 1998*/1991* in play

Zoomed-out View:

🐂 Bullish: if 2033 holds, 2106/2111/19+ in play

🐻 Bearish: as long bears hold 2060 or at last 2085, 1982/78 in play

🔑 Key Levels:

Resistance: 2073, 2080*/85*, 2098*, 2106*, 2114, 2119, 2124*, 2130*, 2141.5, 2153.5*

Support: 2066, 2061/58**, 2051/47, 2038*, 2032*, 2026, 2019*, 2015, 2006*, 1999*, 1991*, 1985*, 1978*/72*, 1965, 1958*, 1952, 1946*

Green Flags:

Keep an eye out for potential signs of a bullish reversal on green days:

Lime Flag: A close above 2085, daily downtrend is in question

1st Green Flag: A close above 2106 on a green day may suggest that the short-term weekly downtrend bias is in question.

2nd Green Flag: If the market closes above 2114 on a green day, indicating potential voiding of the short-term weekly downtrend bias.

Note about Terminology:

In my weekly reports and X (Twitter) posts, I often refer to terms like "must hold," "claim," or "fail." Here's a quick explanation of what these terms mean:

For intraday analysis: I consider the 15-minute or 1-hour candle close.

For trades spanning overnight to two days: I focus on the 4-hour candle close.

For a weekly or longer-term outlook: I rely on the daily candle close.

close above: claimed / close below: failed

These references are also available in the pinned thread on my X profile. I strongly recommend reading that thread for a deeper understanding of my chart analysis. While I plan to elaborate on my methodology in a separate Substack post in the future, the pinned thread on my X profile offers valuable insights for now.

Read this thread on X to learn about hold/fail/claim/reject setups that worked

Curious about your trading experiences. Share your trading moves inspired by this newsletter – the wins, the almost-wins, and the lessons learned. Drop your insights in the comments below or over on X (formerly Twitter). Let's learn and grow together!

Be nimble and adjust your strategies according to market conditions and the mentioned support and resistance levels. Monitor flag levels for early signs of bias shifts. If you're not following me on X @trdnvestor , consider doing so for daily updates.

Happy Independence Day & may you be on the right side of the market!

Disclaimer: This is NOT financial advice. I am NOT a financial advisor.

Thanks for the outstanding service , appreciate it !