Weekly Charts Reading for 5/6- 5/10

Sell in May ...?

Just a heads-up, I won't be able to drop the usual weekly report next weekend because I'll be traveling.

If I can manage it, I'll try to share the key levels on X (formerly Twitter).

Thanks for rolling with it and your continued support!

How’s last week?

#ES:

After failing to hold 5116, most bearish plays worked, finding support at 5038.

5038 support tested twice: Wednesday and Thursday.

Two unexpected moves:

Reached 5154.25 instead of 5160/66 as expected after claiming 5144, sharply reversed.

Held 5144 after FOMC, hit multiple targets, but sharply reversed at 5127.

Apart from exceptions, had a good week with bi-directional trading.

#NQ:

After failing to hold 17815, most bearish plays worked, finding support near 17400 instead of the expected 17450 or 17375.

Two unexpected moves:

Reversed sharply after hitting 17949 post claiming 7900. (17970 was target)

Tuesday's flush tested 17450 and on Wednesday 17372 held, then rallied to 17793 after FOMC before reversing.

Overall good week with some exceptions in trading.

#RTY:

Expected bullish week, saw strong green week despite retracement before bouncing back to 2065.

Similar to #ES and #NQ, Monday's close didn't materialize a test of 2036, reversed from 2031.7 instead.

Tuesday's flush triggered bearish plays which worked precisely, hitting key 1974 support. (1972.1 low)

As 1974 held, bulls reclaimed levels one by one ultimately hitting 2058 & 2065 targets, though have not claimed yet.

Provided ample opportunities for bi-directional plays.

Read here how I use this Weekly Newsletter in my daily trading

Given the abundance of numbers in this newsletter, there's a chance I might make a typo. If you spot any errors, please give me a heads up. Thanks a bunch!

Disclaimer: This is NOT financial advice. I am NOT a financial advisor.

Please note, if I don't hit 500 subscribers in the next couple of months, I might have to reconsider whether this newsletter is hitting the mark. It's a lot of work, and if it's not resonating with enough people, it might be time to call it quits.

A big thank you to those of you who've been cheering me on and encouraging me to keep publishing. Your support means the world!

Thanks, all!

Week Ahead (5/6 – 5/10)

Bulls continued to hold all key support levels.

Interestingly, all indices hit their respective 2nd weekly key resistance levels, but they haven't been claimed yet.

Given the light economic calendar for next week, bulls have an opportunity to capitalize on the momentum from Thursday and Friday early in the week. This could potentially lead to the claiming of immediate key resistance levels. These are 5166, 18050 and 2058/65 for #ES, #NQ and #RTY respectively.

Claiming these immediate key resistance levels quickly and testing the next resistance, followed by consolidation between Friday's highs and the next resistance level, would indicate a bullish trend.

However, failing to claim these resistances early in the week and instead basing below them could lead to deeper retracement before any upward movement.

It's crucial for bulls to defend Friday's lows in either scenario.

Last Tuesday, all indices closed their monthly candles in strong red, signaling a bearish intention on a higher timeframe.

To counteract last month's bearish pressure, #ES needs to claim 5215, #NQ needs to claim 18350, and #RTY needs to reach 2114 to aim for new all-time highs or yearly highs.

Under analysis of #ES, #NQ, and #RTY, specific levels where bears may exert strength have been identified.

As indicated over the past three weeks, there seems to be a readiness for a breather among #DXY/$USD bulls. This played out last week.

Furthermore, the bullish move in #YM early in the week removed some uncertainty in the equities market.

However, the close of #DXY on Friday isn't convincingly bearish; bears need to hold 105.345 to sustain downward momentum. Otherwise, even a local reversal to the upside could introduce more volatility and uncertainty in the equities market.

Last week's close of #YM also appears bullish.

As with the rest of the indices, defending Friday's lows is crucial for #YM bulls to maintain upside momentum, targeting at least 39220/39280. A key immediate support for long entry is observed at 38800.

As always, specific levels for both bearish and bullish plays have been identified and remain relevant for analysis.

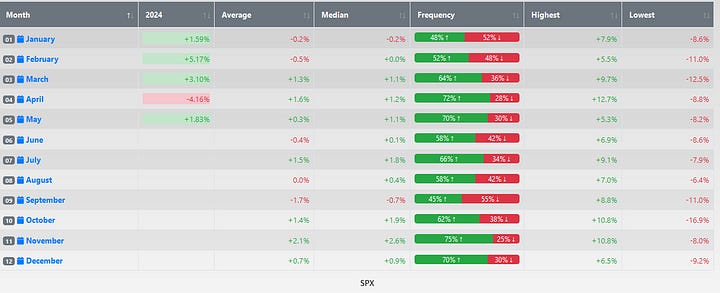

Note about Seasonality

In the world of trading, there's always a lot of chatter about May and seasonality. But here's the thing: seasonality plays a role until it doesn't 🙂

Take a look at the table below to see when it did and when it didn't in 2024 so far.

Feel free to scroll down to the end of the report to get a rundown on some of the terms I'm throwing around, like "hold," "claim," and “fail”

Events Calendar:

Next week seems way calmer compared to the crazy buzz of last week's FOMC rate decision and press conference. The usual suspects start rolling in on Thursday with reports like Unemployment Claims and the 30-year Bond Auction, followed by Consumer Sentiment on Friday.

Note about charts:

Check out the daily chart links provided for a closer look at the detailed levels.

#ES_F / $SPX Futures:

📈 Weekly: caution 🐂 📊 Daily: caution 🐂

Analysis:

Week closed in the green, though just barely.

After Tuesday's sharp flush, Wednesday witnessed bulls defending key support at 5038, resulting in a rapid 100+ point upswing followed by a reversal near day's end.

Bulls defended 5038 once more during Thursday's morning flush, driving the price higher.

Both Thursday and Friday displayed strong bullish moves.

Hence, the weekly and daily bias remains bullish.

April's monthly candle closed bearish, signaling ongoing monthly bearish pressure until we see a green week or at least day close above 5215.

Until then, adding caution to bullish bias.

Friday's high aligned precisely with the 5066 key resistance level written about in last few weeks.

Potential resistance levels ahead include 5166, 5182/5185, 5194, 5207*, and 5215*/5219*, where bearish strength might surface.

Once 5215 is claimed, a shift toward more "buy the dips" action is anticipated.

Bulls still need to claim 5166 on a daily basis.

Since Friday’s close triggered lime flag, next week, it's crucial for bulls to protect Friday's open/low in case of a deep retracement.

Crucial levels to watch include 5114, 5104, and 5099.

Momentum remains intact above 5114.

Bulls enters pain zone below 5104.

Beware of potential confusion and increased volatility if the market dips below 5099, as the market tends to inflict maximum pain on both bulls and bears.

In such a scenario, defending 5091 becomes imperative, followed by a quick reclaim of 5099 and 5104 to confirm bullish intentions.

If a hard rejection from 5215/5219 triggers a deeper flush, holding levels at 5104 and 5099 would be pivotal.

A red day close below 5099 might bring 5064 and 5048 back into focus.

A quick dip below 5099 (e.g., to 5092) followed by a fast reclaim of 5099 is still a bullish sign.

If 5035 fails to hold on a red day, #ES might be headed for new lows.

On the bullish side, claiming 5166 could trigger targets at 5207, 5215, and 5219, with interim resistance at 5182/5185 and 5194.

Remember to refer to the levels outlined in the monthly bearish viewpoint below.

Stick to trading level by level as usual.

General trade plan for long trades:

If 5153/5146 holds and 5166 is claimed, targets are 5182/5185, 5194, and 5207/5215.

General trade plan for short trades:

If 5099 fails, targets are 5064/5054. If that fails, 5048/5042 are next, followed by 5035/5022 and 5006/5000.

Yearly View:

🐂 Bullish: As long as 4420/4350 holds, 5615/6110+ is in focus.

🐻 Bearish: Will determine when monthly trend turns bearish.

Monthly Viewpoint:

🐂 Bullish Goal: As long as 5185 holds/reclaimed, 5370/5445 is in focus.

🐻 Bearish Goal: As long as bears hold 5215, 4815/4805/4702- is in play.

Weekly Perspective:

🐂 Bullish: If 5153/5146 holds and 5166 is claimed, 5207/5215/5219/5241+ is in play.

🐻 Bearish: If 5099 fails, 5064/5054/5048/5035- is in play.

Level by Level Bullish Play (on Daily):

If 5153/5146 holds and 5166 is claimed, targets are 5186, 5195, and 5209.

If 5209 is claimed, targets are 5215, 5219, and 5229.

If 5219 is claimed, targets are 5233, 5241, and 5249.

If 5249 is claimed, targets are 5264, 5268, and 5273.

Level by Level Bearish Play (on Daily):

If 5146 fails, targets are 5130/5127.

If 5127 fails, targets are 5114, 5104, and 5099.

If 5099 fails, targets are 5086/5080.

If 5080 fails, targets are 5064/5054.

If 5054 fails, targets are 5048/5042/5035.

If 5035 fails, targets are 5022/5012/5006.

If 5006 fails, targets are 5000/4990/4982.

Zoomed-out View:

🐂 Bullish: If 5132 is reclaimed, targets are 5215/5249/5273/5288.

🐻 Bearish: If 5035 fails to hold, targets are 5000/4963/4825/4874.

🔑 Key Levels:

Resistance levels: 5166, 5182/5186, 5195, 5209, 5215/5219, 5229/5233, 5241/5249, 5268/5273, 5288, 5305/5317, 5329, 5337, 5345, 5353, 5366, 5377.

Support levels: 5153/5146, 5130/5127, 5114, 5104/5099, 5086/5080, 5072, 5064/5054, 5048/5042, 5035, 5022, 5012, 5006/5000, 4990, 4980, 4968/4960, 4955, 4935/4925, 4908, 4898/4890, 4874/4866, 4848/4841.

Possible Trade Plans:

Long Trades:

If Sunday opens down but on lower time frame signs of 5153 or 5146 holding, then consider long trade with SL below local low and 5153 or 5166 & 5172 as targets

If Sunday opens up & start pulling back from 5172, wait to see if after gap fill of 5162, price is holding that level. Now two choices, go long upon seeing 5162 holding with SL below 5153 & 5166, 5172 & 5182 as targets OR wait for 5166 to be reclaimed and go long.

If price holds 5130 or drops below 5130 say 5127 & quickly claims 5130 on lower time frame, then consider long trade with SL below 5130 and 5146, 5153* and 5166 as targets.

If price holds 5114 or drops below 5114 say 5110 & quickly claims 5114 on lower time frame, then consider long trade with SL below 5114 and 5130, 5146* and 5153 as targets.

If price holds 5104 or 5099 or drops below 5104 or 5099 say to 5100 or 5091 & quickly claims 5104 or 5099 on lower time frame, then consider long trade with SL below 5104 or 5099 and 5114, 5130* and 5146 as targets.

If price holds 5064 or drops below 5064 (say 5057) & quickly reclaims 5065 on lower time frame, consider long trade with SL below 5060 & 5080, 5086 and 5100 as targets.

If price holds 5048 or drops below 5048 (say 5042) & quickly reclaims 5042 on lower time frame, consider long trade with SL below 5048 & 5054, 5060/5064 and 5080 as targets

Short Trades:

If Sunday opens up but lower time frame signs of 5166 or 5172 rejection appears, consider short trade with SL above 5166 or 5172 (or local top) and 5153 and 5146 as targets (quick short trade - can take profit before target hits)

On lower time frames if rejection of 5182/5186 appears, consider short trades with SL above these levels and with 5166, 5160 and 5153 as targets

On lower time frames if rejection of 5195 appears, consider short trades with SL above 5195 and with 5186/5182, 5172 and 5166 as targets

On lower time frames if rejection of 5207/5215 appears, consider short trades with SL above these levels and with 5195, 5186 and 5182 as targets

Green Flags:

Keep an eye out for potential signs of a bullish reversal on green days:

Lime Flag: A close above 5132 on a green day could indicate that the daily downtrend bias is in question. (triggered May 3rd)

1st Green Flag: If the market closes above 5215 on a green day, it may suggest that the short-term weekly downtrend bias is in question.

2nd Green Flag: A significant bullish confirmation could occur if the market closes above 5249 on a green day, potentially voiding the short-term weekly downtrend bias.

#NQ_F / #NDX Futures:

📈 Weekly: Cautious 🐂 📊 Daily: Cautious 🐂

Analysis:

Week ended as expected, closing in green.

Maintaining a bullish bias for both weekly and daily perspectives.

Caution persists until 18350 is claimed on the weekly chart or at least on the daily chart.

Triggered 1st green flag with Friday's green day close above 17970.

Hence Friday's open and low levels critical for bulls to defend in case of a significant retracement.

Key levels to watch: 17890, 17760, and 17720.

Momentum remains above 17890.

Below 17805, bulls face increased pressure.

Dip below 17720 could bring confusion and intensified challenges.

In such a scenario, defending 17675 becomes crucial, followed by a quick reclaim of 17720 and 17745.

Friday's high precisely hit the 18050 level, previously significant support in April.

To sustain Friday's momentum, bulls need to hold 17970 or at last 17930 and reclaim 18050, followed by maintaining 17970 in any pullback thereafter.

As long as 17930 or 17890 holds, targets include 18110 and 18150.

After claiming 18150 on the daily, targets shift to 18325 and 18350, with intermediate resistance at 18225 and 18260.

Possible levels where bears may show strength: 18110, 18150, 18300, and 18350.

Maintain a level-by-level trading approach as usual.

Yearly View:

🐂 Bullish: As long as 14265/14140 holds, targets include 20320 and 22640.

🐻 Bearish: A shift to bearish will be determined when the monthly trend turns bearish.

Monthly Viewpoint:

🐂 Bullish Goal: Targets of 19035, 19710, and 20190 remain in play as long as 16690 holds.

🐻 Bearish Goal: Bears need to maintain 18350 or at least 18150 for targets of 16690, 16470, and 16350.

Weekly Perspective:

🐂 Bullish: Targets include 18110, 18150, 18225, and 18325 if 17970 or 17930 holds and 18050 is reclaimed.

🐻 Bearish: Targets shift to 17760, 17720, 17530, and 17475 if 17890 fails.

Level by Level Bullish Play (on daily):

If 17970 or 17930 holds and 18050 claimed, 18110*/150* in play

If 18150 claimed, 18225/18260 next

If 18225 claimed, 18325/18350* in play

If 18350 claimed, 18445/18500* next

If 18500 claimed, 18550/18570* in play

If 18570 claimed, 18595*/18625* next

Level by Level Bearish Play (on daily):

If 17930 fails, 17890/17805 in play

If 17805 fails, 17760/17720* next

If 17720 fails, 17675/17630* in play

If 17630 fails, 17530*/17475 next

If 17475 fails, 17430/17372*/17330* next

If 17330 fails, 17285*/17220 in play

🔑 Key Levels:

Resistance: 18050*, 18110/150**, 18225, 18325/18350**, 18430, 18485, 18507/20*, 18568*, 18595, 18625*, 18690*, 18735*

Support: 17970*, 17930, 17890*, 17815*, 17760/17720*, 17675, 17630, 17530*, 17475/17450*, 17372/17330*, 17285, 17220*/17180*, 17140*/17115*, 17100, 17040, 16982, 16855*/16835*, 16760, 16690*/60*

Possible Trade Plans:

Besides level by level plays detailed above, follow are possible additional long and short trade opportunities to consider.

Long Trades:

If Sunday opens down but on lower time frame see signs of 17970 holding (ideally dip near 17960 & reclaim of 17975), then consider long trade with SL below 17970 and 18000, 18050 and 18080 as targets

If Sunday opens up & start pulling back from 18050, wait to see if after gap fill of 18825, price is holding that level. Now two choices, go long upon seeing 18825 holding with SL below 18825 & 18050, 18080 & 18110 as targets OR wait for 18050 to be reclaimed and go long.

If price holds 17760 or drops below 17760 say 17740 & quickly claims 17760 on lower time frame, then consider long trade with SL below 17760 and 17805, 17850 and 17890 as targets.

If price holds 17720 or drops below 17720 & quickly reclaims 17720 on lower time frame, consider long trade with SL below 17720 & 17760, 17805, 17850 and 17890 as targets.

If price holds 17675 or drops below 17675 (to say 17660) & quickly reclaims 17675 on lower time frame, consider long trade with SL below 17675 & 17730, 17770, 17815, 17850 and 17870 as targets.

If price holds 17475 on lower time frame or quickly reclaims 17475 after quick drop to 17450 on lower time frame, consider long trade with SL below 17475 & 17530, 17590 & 17630 as targets

If price holds 17330 on lower time frame or quickly reclaims 17330 after quick drop to 17315 on lower time frame, consider long trade with SL below 17330 & 17372, 17450 and 17495 as targets

If price holds 17180 on lower time frame or quickly reclaims 17180 after quick drop to 17165 on lower time frame, consider long trade with SL below 17180 & 17230, 17285 and 17330 as targets

Short Trades:

If Sunday opens up but below 18050 and on lower time frame signs of failing 17970 support appears, consider short trade with SL above 17970 and 17930 and 17890* as targets

If Sunday opens down & on lower time frame signs of failing 17890 appears, then consider short trade with SL above 17890 and 17850, 17805* and 17760* as targets

On lower time frames if rejection of 18110/150, 18300/18350 appears, consider short trades with SL above these levels and with next 2nd or 3rd support levels below as targets.

Green Flags:

Keep an eye out for potential signs of a bullish reversal on green days:

Lime Flag: A close above 17555 on a green day could indicate that the daily downtrend bias is in question. (Triggered on Apr 23)

1st Green Flag: If the market closes above 17970 on a green day, it may suggest that the short-term weekly downtrend bias is in question. (triggered May 3rd)

2nd Green Flag: A significant bullish confirmation could occur if the market closes above 18350 on a green day, potentially voiding the short-term weekly downtrend bias.

#RTY_F / #RUT Futures:

📈 Weekly: Cautious 🐂 📊 Daily: Cautious 🐂

Analysis:

The week wrapped up positively, but Friday's attempt to close above 2065 fizzled out, although bulls managed to hold the line at 2042 later in the day.

Our outlook remains bullish for both the weekly and daily trends, but the failure to secure a close above 2065 delays the potential trigger of the 2nd green flag, prompting a note of caution.

On Friday, the close above 2036 marked the activation of the 1st green flag, indicating some positive momentum.

It's essential for bulls to monitor key levels, particularly Friday's open and low, with a keen eye on 2026 and 2019, which could be crucial next week.

Momentum remains robust as long as we stay above 2036, but dropping below 2026 could signal pain ahead.

A dip below 2019 might rattle the confidence of bulls, potentially causing further pain.

If such a scenario unfolds, bulls after quick dip to 2016.5/2012, must swiftly reclaim the levels at 2019 & 2022 to solidify their bullish intentions

To maintain the momentum from Friday, the focus should be on holding 2042, or at the very least 2036, and quickly claim 2058 and 2065.

Once 2065 is claimed, the next targets become 2100 & 2112.

It's worth noting that bulls can't breathe easy until we witness a green day closing above 2065.

Keep an eye out for potential areas where bears may show strength, such as 2058/2065, 2100/2107, and 2114.

Additional insights can be gleaned from the monthly bearish viewpoints.

Maintain a level-by-level trading approach as usual.

Yearly View:

🐂 Bullish: Holding 1867 targets 2247/2461/2575+

🐻 Bearish: Monthly trend shift to determine

Monthly Viewpoint:

🐂 Bullish: Holding 2053/2032 or reclaiming 2247/2300+ crucial

🐻 Bearish: Holding 2058 or at least 2036 targets 1905/1810

Weekly Perspective:

🐂 Bullish: If 2045/42 or 2036 holds and 2058 reclaimed, targets at 2065/2091.5/2100/2107+

🐻 Bearish: Failure at 2019 targets 2009/1998/1991/1985/1978-

Level by Level Bullish Play (on daily):

If 2045/42 or 2036 holds, 2052/58*/65* in play

If 2065 claimed, 2074 next

If 2074 claimed, 2086*/2091.5 in play

If 2091.5 claimed, 2100/2107 next

If 2107 claimed, 2114* in play

If 2114 claimed, 2126/2136 next

Level by Level Bearish Play (on daily):

If 2036 fails, 2026/2019* in play

If 2019 fails, 2012/2009 next

If 2009 fails, 1998/1991* in play

If 1991 fails, 1978/1972* next

If 1972 fails, 1965/1958 in play

If 1958 fails, 1952*/1946 next

If 1946 fails, 1936/1925* in play

Zoomed-out View:

bullish: if 2095 holds/reclaimed, 2190/2198 in focus (failed so far)

bearish: if 2019 fails, 1978/1972/1965/1958- in play

🔑 Key Levels:

Resistance: 2052, 2058*, 2065*, 2074, 2086*/2091.5, 2100*/2107*, 2114*, 2126/2130, 2141.5, 2153.5, 2162.5/2169*

Support: 2045/42*, 2036, 2026*, 2019*, 2012*/2009, 1998*/1991*, 1985*, 1978*/72*, 1965, 1958, 1952/1946*, 1936, 1925*, 1914, 1905/1902*, 1896, 1887, 1880*, 1870, 1863, 1852/1848.5*

Green Flags:

Keep an eye out for potential signs of a bullish reversal on green days:

Lime Flag: A close above 2001 on a green day could indicate that the daily downtrend bias is in question. (Triggered Apr 23rd)

1st Green Flag: If the market closes above 2036 on a green day, it may suggest that the short-term weekly downtrend bias is in question. (Triggered May 3rd)

2nd Green Flag: A significant bullish confirmation could occur if the market closes above 2065 on a green day, potentially voiding the short-term weekly downtrend bias.

Note about Terminology:

In my weekly reports and X (Twitter) posts, I often refer to terms like "must hold," "claim," or "fail." Here's a quick explanation of what these terms mean:

For intraday analysis: I consider the 15-minute or 1-hour candle close.

For trades spanning overnight to two days: I focus on the 4-hour candle close.

For a weekly or longer-term outlook: I rely on the daily candle close.

close above: claimed / close below: failed

These references are also available in the pinned thread on my X profile. I strongly recommend reading that thread for a deeper understanding of my chart analysis. While I plan to elaborate on my methodology in a separate Substack post in the future, the pinned thread on my X profile offers valuable insights for now.

Read this thread on X to learn about hold/fail/claim/reject setups that worked

Curious about your trading experiences. Share your trading moves inspired by this newsletter – the wins, the almost-wins, and the lessons learned. Drop your insights in the comments below or over on X (formerly Twitter). Let's learn and grow together!

Be nimble and adjust your strategies according to market conditions and the mentioned support and resistance levels. Monitor flag levels for early signs of bias shifts. If you're not following me on X @trdnvestor , consider doing so for daily updates.

Be Happy Managing Risk in Trading!

Disclaimer: This is NOT financial advice. I am NOT a financial advisor.