Weekly Charts Reading for 12/04 - 12/08

Bovine Break Retry?

How’s last week?

End-of-month red day materialized only for #NQ, contrary to the expected performance across all four index futures.

December did not initiate with a red day, deviating from the anticipated start.

Despite not following news or Powell's statements, it seems the market either disregarded Powell on Friday, or he lacked his usual bearish tone, signaling a potential shift in market sentiment noted in his recent talks.

Despite the anticipation of an overall cautious bullish momentum last week (excluding #NQ), the week closed on a very bullish note for #ES, #YM, and #RTY.

#ES and #NQ hit their first weekly targets at 4608 and 16196, respectively.

#YM and #RTY not only met but significantly exceeded their targets above 35650 and 1848.

As expected, #NQ lagged and consolidated after quickly hitting its first target on Wednesday.

Last Sunday, considering the events calendar and #NQ price action, a red day on Friday was expected. However, Friday morning, levels for bulls to hold and reclaim for a green outcome were posted on X, and bulls precisely achieved that.

A notable feature was that all four futures precisely held and respected the support levels identified last week.

The #DXY retest bounce hit precisely at 103.740 (103.722 high), occurring after reaching the low targets of 103.010 and 102.810, introducing weakness in ES and NQ on Thursday.

To assess how last week's levels performed, a quick review of this thread on X (formerly Twitter) where before and after charts with levels from the last week's newsletter have been posted would be insightful.

Read here how I use this Weekly Newsletter in my daily trading

If you find my content valuable, please hit the like button on Substack and consider sharing the newsletter link on X. Your support through likes, restacks, shares, and reposts motivates me to continue publishing.

If engagement doesn't improve in the upcoming weeks, I may reassess the newsletter's continuation.

Feel free to share any suggestions for improvement in the comments.

Week Ahead (12/04 – 12/08)

Friday's bullish momentum may extend into Sun/Mon and potentially uphold key support levels.

Ideally, bulls should undergo a cooling-off period and consolidation for the ongoing upward march. One or two red weeks are acceptable, provided the pullback is shallower and respects our red flag levels.

Despite the potential for a pullback, the preference is to observe support failure before turning overtly bearish. In intraday plays, opportunities to go short can still be considered.

Factors Favoring Bears:

Geopolitical conflicts and other macro conditions.

#NQ bulls exhibit a lack of conviction despite hitting the 16196 target.

Similar to recent weeks, most indices hover around or near their weekly/monthly resistance levels.

Doubts linger about bearish conviction despite #DXY closing the week in red.

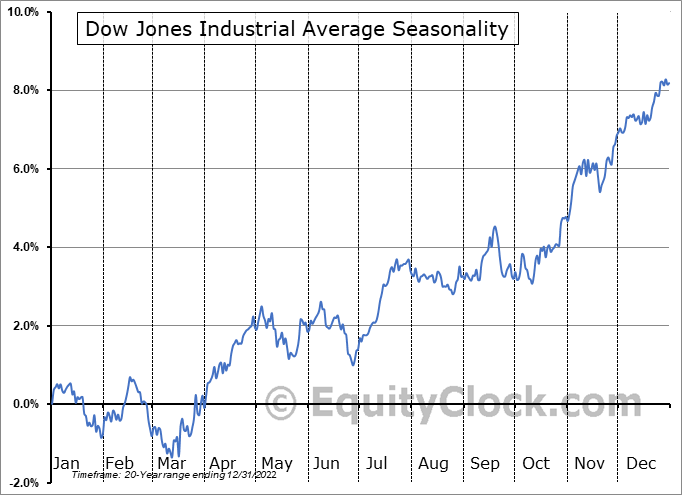

Seasonality charts indicate favorability for #NQ bears.

Factors Favoring Bulls:

While #NQ shows less conviction, other indices demonstrate continued bullish strength.

If #DXY continues to show weakness, it could lead to an upside move in #ES and #NQ.

Seasonality charts indicate favorability for #YM bulls.

Note: My expertise doesn't extend to geopolitics or macro / micro economic analysis. Therefore, I categorize geopolitical conflicts and macroeconomic conditions as factors that favor the bears, as they often introduce uncertainty and challenges to the market.

In the world of trading, there's always a chatter about seasonality. But here's the thing: seasonality plays a role until it doesn't. Recent example is this October.🙂

Feel free to scroll down to the end of the report to get a rundown on some of the terms I'm throwing around, like "hold," "claim," and “fail”

Disclaimer: This is NOT financial advice. I am NOT a financial advisor.

Events Calendar:

The upcoming week's events calendar is packed with regular economic reports scheduled throughout the week. This provides the market with multiple reasons to experience volatility. It's important to note that, for me, volatility is defined as the maximum price movement in a day from high to low, especially with significant swings—similar to what was observed this past Friday. It's important to note that this definition of volatility differs from the VIX index

#ES_F / $SPX Futures: Breakout for real?

📈 Weekly: cautious🐂 📊 Daily: Cautious 🐂

Analysis:

Throughout the week, bulls maintained control, showcasing resilience with a swift recovery of key support levels for the fifth consecutive week. This consistent upward trend keeps my bias bullish.

However, a note of caution is warranted as we observe five consecutive green weeks, and the weekly candles are gradually shrinking.

On Friday, the market closed above the trend line originating from the ATH and July high, reinforcing the bullish sentiment. The crucial levels for bulls to defend are 4570 & the low of that day.

If 4562 (Friday's low) fails to hold, a quick bounce and recovery from 4552/4545 (last week's lows), securing 4562, would maintain the bullish momentum. However, a close below 4562 could raise concerns about the daily uptrend, marked by an orange flag.

Despite this caution, the strong weekly close, coupled with Friday's bullish momentum expected to carry over, makes a test of 4536 seem likely. The timing of this move remains uncertain—whether it unfolds this week or later.

It's essential to highlight that all flag levels have been adjusted, providing early warnings of a potential trend change and maintaining flexibility in bias.

Monthly Viewpoint:

🐂 Bullish Goal: 4770/ATH

🐻 Bearish Goal: Decide upon observing a daily trend change.

Weekly Perspective:

🐂 Bullish: If 4592/4582 holds or reclaimed, 4625/4636+ in play.

🐻 Bearish: Failure at 4582 targets 4544/4530.

Level by Level Bullish Play (on Daily):

If 4592/4582 holds, target 4619/4625.

Upon claiming 4625, targets shift to 4636.

Close above 4636 focuses on 4660/4672.

Level by Level Bearish Play (on Daily):

If 4582 fails, target 4570/4562.

If 4562 fails, targets are 4552/4545.

If 4545 fails, downside target is 4530.

Zoomed-out View:

As long bulls hold 4562, test of 4625/4672 likely; a red day below 4562 voids last week's bullish move.

🔑 Key Levels:

Resistance: 4610*, 4619/4625*, 4636*, 4645, 4660/4672*

Support: 4592/4582, 4570/4562, 4552/4545*, 4530/4520*

Possible Trade Plans:

Considering the above analysis and key levels, here are some potential trade plans:

Long Trade:

If the market opens lower but holds 4592, opportunity to go long with stop loss below 4592 & first target 4610 & second 4619 & 4625 third.

If the market opens lower but holds 4582, opportunity to go long with stop loss below 4582 & first target 4603 & 4610 second.

Wait for market to claim 4610, look for signs 4603 is holding & enter at opportunity to go long with stop loss below 4603 & first target 4619 & 4625 second.

If market hasn't hit 4619 and signs of 4544 support holding, go long at 4570 with stop loss below 4570 & 4592 as first target and 4610 2nd target and 4619 as 3rd target

Short Trades:

If market opens up but fails to hold 4610, look for signs that 4610 being rejected on lower time frame, then short with stop loss above 4610 & 4592 as first target, 4582 2nd target

If the market fails to hold 4582, bears reject the 4582 level, assess the setup at that point and consider a short position with a stop loss just above 4582 and a first target of 4570/4562.

Note: These examples illustrate my approach to the levels. Variations may occur based on actual entry and market conditions.

Red Flags: Keep an eye out for potential signs of a bearish reversal on red days.

As the market moves up, adjusted flag levels up for early detection of a short-term trend change.

Orange Flag: A close below 4562 questions the daily uptrend.

1st Red Flag: A close below 4545 on a red day suggests a potential shift in the short-term weekly uptrend bias.

2nd Red Flag: If the market closes below 4520 on a red day, it indicates a potential voiding of the short-term weekly uptrend bias.

#NQ_F / #NDX Futures: Time for a bear yet?

📈 Weekly: Cautious 🐻 📊 Daily: Cautious 🐂

Analysis:

While we witnessed the fifth consecutive green week, the narrowing range suggests potential pause in the bullish momentum.

Given the seasonally weak first week of December, a pullback becomes likely. Therefore, I maintain a cautious bearish bias for the week and a cautious bullish stance on the daily chart until the identified support levels are breached.

Despite a midweek spike reaching our first weekly target of 16196, bulls swiftly retreated below 16100. The commitment of bulls requires a daily close above 16130 or at least 16100. Until this occurs, the market exhibits weakness.

Friday's bullish close, despite a barely green week, maintains the daily bias as cautiously bullish. The majority of the movement remains within the 15910 - 16100 range, and a decisive move will be prompted when either of these levels is claimed by bulls or bears.

If the bullish strength on Friday extends to Sunday/Monday, defending key support at 15980/15940 becomes crucial. A failure at 15940 might lead to a sharper pullback to 15910/15870, signaling a favorable environment for bears. However, if 15980 is promptly recovered same day, the bullish scenario remains intact.

It's noteworthy that although the orange flag is positioned at 15940, a red day closing below 16010, following a failure to claim 16100, *may* introduce more red day(s).

Monthly:

🐂 Bullish Target: 16355/16600

🐻 Bearish Target: To be determined based on daily trend change

Weekly Play:

🐂 Bullish: If 15980/15940 holds and 16100 is reclaimed, targets are 16196/16270+

🐻 Bearish: A failure at 15940 would bring 15835/15680- into play

Level by Level Bullish Play (on Daily):

If 15980/15940 holds or is reclaimed, targets are 16072/16095.

Upon claiming 16095, focus shifts to 16130/16196.

If 16130 is successfully claimed, 16270 becomes the next target.

Level by Level Bearish Play (on Daily):

If 15940 fails, targets are 15870/15835.

If 15835 is breached, targets become 15720/15680.

If 15680 is compromised, 15590 becomes the downside target.

Zoomed-out View: As long as 15835 holds or is reclaimed, targets of 16270/16355+ remain in play.

🔑 Key Levels:

Resistance: 16050, 16075/16100, 16130*, 16196, 16270*

Support: 15980/15940, 15910/15870, 15835*, 15790, 15720/15680*

Possible Trade Plans:

Long Trade:

If the market opens lower but holds 1592, consider going long with a stop loss below 1592, targeting 1610 and 1619/1625.

If the market opens lower but holds 1582, consider going long with a stop loss below 1582, targeting 1603 and 1610.

Wait for the market to claim 1610, look for signs that 1603 is holding, and enter at an opportunity to go long with a stop loss below 1603, targeting 1619/1625 and 1627.

Short Trades:

If the market opens up but fails to hold 1610, look for signs that 1610 is being rejected on a lower time frame, then short with a stop loss above 1610, targeting 1592 and 1582.

If the market fails to hold 1582, bears reject the 1582 level, assess the setup at that point, and consider a short position with a stop loss just above 1582, targeting 1570/1562.

Red Flags:

As market moved up, moving flag levels up aggressively for early detection of short-term trend change as below:

Orange Flag: A close below 15940; daily uptrend is in question.

1st Red Flag: A close below 15835 on a red day may suggest that the short-term weekly uptrend bias is in question.

2nd Red Flag: If the market closes below 15550 on a red day, indicating potential voiding of the short-term weekly uptrend bias.

#YM_F / #DJI Futures: Why stop now?

📈 Weekly: Cautious 🐂 📊 Daily: Cautious 🐂

Analysis:

Another week of remarkable bullish momentum for #YM! Bulls precisely held the 35325 support for two consecutive days, and Friday’s move surpassed our weekly targets by several levels. If you were bullish on YM, the week likely worked in your favor.

Bulls successfully claimed multiple key levels last week, prompting me to move up flag levels to signal potential short-term trend changes. While the continuous bullish moves bring excitement, caution is essential, as I've emphasized in recent weeks. However, it's equally unwise to actively seek short trades solely based on the prolonged bullish trend.

Support levels are identified to gauge potential short opportunities if they fail. Bulls retain control until a red day closes below the orange flag level. The momentum from last week is anticipated to carry over into the early part of the upcoming week (Sun/Mon/Tues).

If 36185 fails, a quick drop to test 36070/35960 is likely. A swift recovery on the same day, closing above 36100, would keep bulls in play.

Monthly Viewpoint:

🐂 Bullish Target: ATH / 37900

🐻 Bearish Target: To be decided upon observing a trend change on the daily chart

Weekly Perspective:

🐂 Bullish: If 36240/36185 holds or is reclaimed, 36575/ATH is in play.

🐻 Bearish: A failure at 36185 would bring 36070/35960- into play.

Level by Level Bullish Play (on Daily):

If 36240/36185 holds, 36420 is in play.

Upon claiming 36420, the focus shifts to 36575.

If 36575 is successfully claimed, 36665/36760/ATH becomes the next target.

Level by Level Bearish Play (on Daily):

If 36185 fails, 36100/36070 is in play.

If 36070 fails, 35960 becomes the next target.

If 35960 fails, 35810/35710 is the subsequent downside target.

Zoomed-out View: As long as 35960 holds or is reclaimed, 36575/ATH remains in play.

🔑 Key Levels:

Resistance: 36420*, 36575*, 36665, 36760, 36835*

Support: 36240/36185, 36100/36070, 35960*, 35810, 35710

Possible Trade Plans:

Long Trade:

Depending on the price's position before reaching the three key support levels—36240, 36185, and 36100—multiple potential long trade opportunities may arise.

If the market hasn't hit 36575 and reclaims 36420, look for signs of holding 36240, then go long with a stop loss below 36240, targeting 36420, 36575, and 36665.

Short Trade:

If 36420 is rejected on a smaller time frame and 36070 hasn't been tested, consider going short around 36420 with a stop loss above 36420, targeting 36240, 36185, and 36070.

If 36185 fails, depending on the actual setup, consider going short near 36240 with a stop loss above 36240, targeting 36100, 36070, and 35960.

Red Flags:

As the market moved up, flag levels were raised aggressively for early detection of a short-term trend change as below:

Orange Flag: A close below 35960; the daily uptrend is in question.

1st Red Flag: A close below 35560 on a red day may suggest that the short-term weekly uptrend bias is in question.

2nd Red Flag: If the market closes below 35315 on a red day, it indicates potential voiding of the short-term weekly uptrend bias.

#RTY_F / #RUT Futures: Playing catch-up?

📈 Weekly: Cautious 🐂 📊 Daily: Cautious 🐂

Analysis:

What an explosive bullish move! However, it's noteworthy that #RTY is playing catch-up, lagging significantly behind others in YTD performance.

Despite attempts to break out of 1815 on Wed & Thurs, bulls were swiftly forced back down.

Friday marked a breakthrough, finally surpassing that level and hitting all our targets and more. Thus, 1815 serves as the orange flag level, with a red day close below indicating weakening bulls and strengthening bears.

Caution for the bullish bias stems mainly from the need for a cooldown period after such an explosive move.

Ideally, after hitting 1872 or 1884, #RTY may want to cool down and move sideways for the next week, holding the key support of 1840 or at least not failing at 1815.

Monthly Viewpoint:

🐂 Bullish Target: 1903/1940

🐻 Bearish Target: To be decided upon observing a trend change on the daily

Weekly Perspective:

🐂 Bullish: If 1852/1840 holds or is reclaimed, 1889/1903 is in play.

🐻 Bearish: If 1840 fails, 1815/1806- is in play.

Level by Level Bullish Play (on Daily):

If 1852/1840 holds, 1872/1884 is in play.

Upon claiming 1872, the focus shifts to 1889/1896.

If 1889 is successfully claimed, 1903/1922 is the next target.

Level by Level Bearish Play (on Daily):

If 1840 fails, 1825/1815 is in play.

If 1815 fails, 1806/1797 is the next target.

If 1797 fails, 1783/1788 is the subsequent downside target.

Zoomed-out View: As long as 1852/1840 holds or is reclaimed, 1903/1925 is likely to be tested.

🔑 Key Levels:

Resistance: 1872, 1884, 1889/1896, 1903*, 1922/1925*

Support: 1852/1840, 1825/1815*, 1806, 1797*, 1788*

Possible Trade Plans:

Long Trade:

If signs of holding 1840 on a lower timeframe are observed, consider going long with a stop loss below 1840 and targets at 1865, 1872, and 1884.

If 1872 is claimed, look for signs of holding 1852 on a lower timeframe and go long with a stop loss below 1852, targeting 1884 as the first target and 1889 as the second.

Short Trade:

If the price hasn't hit 1840 yet and signs of 1872 getting rejected are seen, enter a short position with a stop loss above 1872, 1852 as the first target, and 1840 as the second.

If 1840 fails, depending on the actual setup, go short near 1852 with a stop loss above 1852, targeting 1825 and 1815.

Red Flags:

As the market moved up, flag levels were raised aggressively for early detection of a short-term trend change as below:

Orange Flag: A close below 1815; the daily uptrend is in question.

1st Red Flag: A close below 1797 on a red day may suggest that the short-term weekly uptrend bias is in question.

2nd Red Flag: If the market closes below 1780 on a red day, it indicates potential voiding of the short-term weekly uptrend bias.

#DXY / $USD: Reversing or resting?

📈 Weekly: Cautious 🐻 📊 Daily: Cautious 🐻

Analysis:

$USD continues to move down as expected, hitting targets of 103.010 & 102.810 and beyond (102.467 low).

This move followed the expected path of declining on Mon/Tues and rising on Wed/Thu to close the month.

Although the week closed in red, the bearish momentum seems to have slowed down a bit. Perhaps bears are gathering strength before a potentially more significant move. In any case, a weekly close below 102.810 or at least 103.010 would have instilled confidence in the bears, adding caution to the bearish bias.

Now we'll have to wait to see that close to be certain of the bears' intention to move to 102.295 / 101.960 / 101.740.

Considering all this, the likely path for #DXY is to move down to below 102.295 and even 101.960.

As long as bears hold 103.615, the next targets are 101.960 / 101.740, with 102.295 offering intermediate support.

Above 103.740, bears start getting nervous.

It's worth noting the slight inverse correlation between USD and #NQ #ES is continuing. Hence, if #DXY continues to move down, #ES & #NQ may attempt to move up too.

🔑 Key Levels:

Resistance: 103.615/103.740, 103.920/104.025*, 104.420, 104.560*, 105.735*

Support: 103.010*, 102.810, 102.295, 101.960*, 101.740

Green Flags: Keep an eye out for potential signs of a bullish reversal on green days:

Moving down flags aggressively for early warning of reversal.

Lime Flag: A close above 103.740 on a green day could indicate that the daily downtrend bias is in question.

1st Green Flag: If the market closes above 104.560 on a green day, it may suggest that the short-term weekly downtrend bias is in question.

2nd Green Flag: A significant bullish confirmation could occur if the market closes above 105.735 on a green day, potentially voiding the short-term weekly downtrend bias.

Note about Terminology:

In my weekly reports and X (Twitter) posts, I often refer to terms like "must hold," "claim," or "fail." Here's a quick explanation of what these terms mean:

For intraday analysis: I consider the 15-minute or 1-hour candle close.

For trades spanning overnight to two days: I focus on the 4-hour candle close.

For a weekly or longer-term outlook: I rely on the daily candle close.

close above: claimed / close below: failed

These references are also available in the pinned thread on my X profile. I strongly recommend reading that thread for a deeper understanding of my chart analysis. While I plan to elaborate on my methodology in a separate Substack post in the future, the pinned thread on my X profile offers valuable insights for now.

Curious about your trading experiences. Share your trading moves inspired by this newsletter – the wins, the almost-wins, and the lessons learned. Drop your insights in the comments below or over on X (formerly Twitter). Let's learn and grow together!

Be nimble and adjust your strategies according to market conditions and the mentioned support and resistance levels. Monitor flag levels for early signs of bias shifts. If you're not following me on X @trdnvestor , consider doing so for daily updates.

Wishing your portfolio a week filled with green! 🌿💰

Disclaimer: This is NOT financial advice. I am NOT a financial advisor.