Weekly Charts Reading for 11/6 - 11/10

Change of season?

How’s last week?

If you've been following my updates on X (formerly Twitter), you might have noticed the frequent references to last week's newsletter and how the price action for all five charts was tracking against the predictions.

Summary:

I began the week with a bearish bias, and a cautious bearish outlook on the daily chart. However, as the market remarkably held all the support levels across all indices at the start of week, I quickly shifted to a bullish stance.

The October close for #ES above 4185 provided a strong hint that the bulls were determined to remain in the game.

The lime flag was initially triggered for #YM, followed by #ES_F and #NQ_F, offering further confirmation that the bulls were taking charge in the short term.

All the bullish plays identified in the newsletter turned out to be successful.

As anticipated, #RTY_F (Russell 2000) indeed printed a two-bar weekly reversal pattern.

#DXY (US Dollar Index) respected my resistance level at 107.06 and pulled back sharply, supporting the sustainable upside move in the equities market.

In addition to these insights from the newsletter, the highlight of the week for me personally was the real-time post on Tuesday, which accurately predicted a reversal ahead of time. Checkout here!

Last week witnessed an unusually strong bullish move across all indices. The most impressive performance came from the Russell 2000, which saw an astonishing 8% surge.

However, for most of the indices, apart from #YM, the bulls aren't entirely out of the woods just yet.

Week Ahead (11/06 – 11/10)

After a strong bullish reversal last week, a pullback is expected. A pullback early in the week followed by support holding and a bounce later on could set a bullish tone.

Factors favoring bears:

Geopolitical conflicts and macro conditions.

Rapid ascent to key resistances.

Potential for an overbought pullback.

FOMC member speeches, especially J Powell on Wed & Thurs.

Factors favoring bulls:

Quick strong bullish move with closes above 1st Green flag levels.

#DXY closed below the Orange flag level since Oct. highs

Signs of Russell 2000 recovery.

Possible return of seasonality trends.

Note: My expertise doesn't extend to geopolitics or macro / micro economic analysis. Therefore, I categorize geopolitical conflicts and macroeconomic conditions as factors that favor the bears, as they often introduce uncertainty and challenges to the market.

The bullish momentum is set to continue until we witness a red day closing below Thursday's lows. This level represents a critical point for the bulls to defend. While a pullback to Friday's low may satisfy the bears, as long as the bulls can protect the Thursday lows and end the day in the green, they remain in a secure position. These levels may shift upward if the market begins with an upward move on Sunday or Monday.

Events Calendar for next week:

Next week isn't too eventful, but there are noteworthy events to watch. FOMC members will be speaking all week someplace or other and earnings season is ongoing. Thursday, in particular, is expected to be more volatile, with the Unemployment Claims report in the morning and Jerome Powell participating in an afternoon panel discussion.

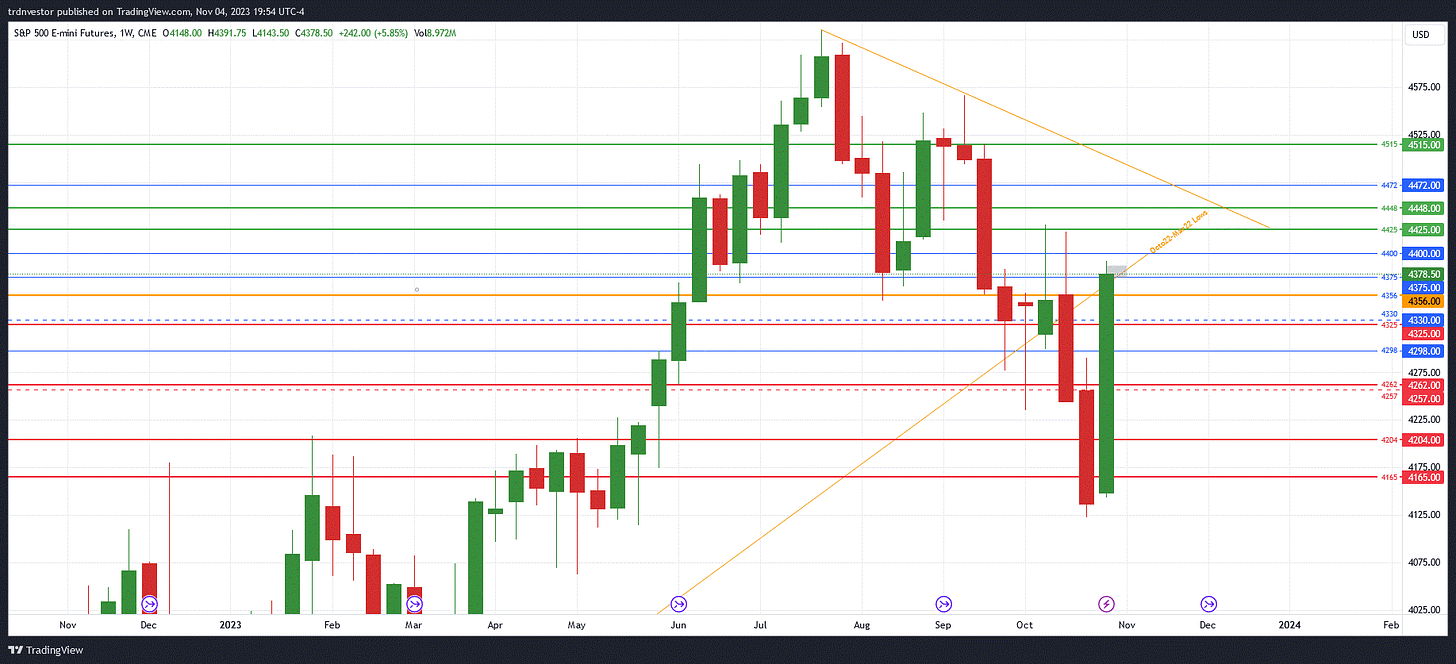

#ES_F / $SPX Futures: Bullish hopes back

📈 Weekly: Cautious 🐂 📊 Daily: Cautious 🐻

Analysis:

Thursday's close triggered the 1st Green flag, casting doubt on the short-term weekly downtrend.

The 4425 level represents the 2nd Green flag, just about 35 points above last week's high.

Bearish hopes remain alive as long as the weekly close stays below 4425.

Two possible scenarios:

a) A pullback on Sunday/Monday to the levels identified below, followed by a bounce on Thursday/Friday to close the week in the green.

b) A continued climb to 4425+ from Sunday/Monday; in this case, must hold key levels for bulls will also move up accordingly.

The daily caution stems from the possibility of an overbought pullback, particularly on Sunday/Monday, when there are no major events on the calendar. It could simply be a technical pullback to reset widely monitored oscillators, indicators etc.

Monthly Viewpoint:

🐻 Bearish Goal: will be decided when a trend changes on the daily chart.

🐂 Bullish Goal: The 4515 level is back in play.

Weekly Perspective:

🐻 Bearish: If 4356 fails, the next support/targets are 4325/4262.

🐂 Bullish: If 4356 holds, 4425 and 4448 are potential targets.

Level by Level Bullish Play (on Daily):

If support at 4375 holds or is reclaimed, the next target is 4400.

Upon successfully claiming the 4400 level, the focus shifts to the significant milestone of 4425.

A close above 4425 would set the stage for targeting 4448/4472.

Level by Level Bearish Play (on Daily):

If 4356 fails to hold, the next targets are 4330/4325.

If 4325 fails, consider 4298 as the next support level.

If 4298 fails, the downside target becomes 4262.

Zoomed-out View:

As long as bulls can maintain control above 4262/4256, the levels of 4448 and 4515 remain in focus. A red day closing below 4256 would nullify last week's bullish momentum, with bears taking charge.

🔑 Key Levels:

Resistance: 4400, 4425*, 4448*, 4472, 4515*

Support: 4375, 4356*, 4326, 4298, 4262/4257*

Possible Trade Plans:

Considering the above analysis and key levels, here are some potential trade plans:

Long Trade:

If the market opens lower but holds 4356, consider going long with a stop loss below 4350 and initial targets at 4375 and then 4400. This trade carries an estimated risk of 15 points for a potential profit of 25 points for the first target and 50 points for the second.

If the market opens lower but holds 4375, an opportunity to go long with a stop loss below 4375 and initial targets at 4400 and then 4425. This trade carries an estimated risk of 10 points for a potential profit of 25 points for the first target and 50 points for the second.

Wait for the market to reclaim 4390, and look for signs that 4385/4375 is holding, then consider entering a long position with a stop loss below 4375 and initial targets at 4425 and 4448. This trade carries an estimated risk of 10 points for a potential profit of 35 points for the first target and 65 points for the second.

Short Trades:

If the market fails to hold 4356 and bears reject the 4363/4365 levels, assess the setup at that point and consider a short position with a stop loss just above 4365 and a target of 4330/4325.

If the market has not yet reached 4356 and fails to hold 4375, pulling back up to 4385 and then rejecting it, look for a bearish setup near 4385 and consider a short position with a stop loss above 4385 and a target of 4363/4356.

Please note that these risk-to-reward calculations are estimates and depend on the actual entry and setup.

Green Flags: Should the market experience a green day, watch for the following bullish reversal signals:

Lime Flag: A close above 4225 on a green day, daily downtrend is in question. This is already triggered.

1st Green Flag: Attaining a close above 4303 on a green day could potentially challenge the short-term weekly downtrend bias.

2nd Green Flag: A significant bullish confirmation may transpire if the green week closes above 4425, potentially negating the short-term weekly downtrend bias.

#NQ_F / #NDX Futures: Bounce we got!

📈 Weekly: Cautious🐂📊 Daily: Cautious 🐻

Analysis:

Bulls successfully held the 14245 support level and closed the week above the 1st Green flag level of 14950.

This suggests the potential for a continuation of the bullish move.

However, caution is advised as although last week's bullish momentum was strong, but the market has not yet closed above the 2nd Green flag at 15340.

A shift in daily bias to bullish would occur if 15130 or 15085 holds on Sunday/Monday.

A lazy shallow pullback followed by a quick recovery would be a bullish for coming weeks.

It's worth noting that after a strong one-sided move, the market often tends to chop or consolidate. During such times, 4-hourly support/resistance levels will be used for entering long or short positions.

Additionally, quick profits will be taken on short positions, even if they are just a few points above the support levels.

Monthly Viewpoint:

🐻 Bearish Target: will be decided when a trend changes on the daily chart.

🐂 Bullish Target: 15520 / 15725

Weekly Perspective:

🐂 Bullish: If 15130/15085 holds or is reclaimed, the levels of 15340/15465+ are in play.

🐻 Bearish: If 15018 fails, the market may target 14925/14760.

Level by Level Bullish Play (on Daily):

If 15130/15085 holds or is reclaimed, the next levels to watch are 15340/15370.

Once 15370 is claimed, the focus shifts to 15465.

After 15465 is claimed, the next milestone is 15590.

Level by Level Bearish Play (on Daily):

If 15018 fails, consider targeting 14950/14925.

If 14925 fails, the levels to consider become 14585.

Should 14585 fail, the downside target becomes 13805/13710.

Zoomed-out View:

As long as 14925 or at least 14760 holds, the levels of 15465 and 15680+ remain in play.

🔑Key Levels:

Resistance: 15245, 15340/15370, 15465, 15590, 15680

Support: 15130/15085, 15018, 14950/14925, 14760, 14585

Possible Trade Plans:

Considering the above analysis and key levels, here are some potential trade plans:

Long Trade:

If the market opens lower but holds 15130/15085, consider going long with a stop loss below this level. Initial targets are 15245/15340.

If 15370 is claimed, look for opportunities to go long with the next target at 15590.

Please note that these risk-to-reward calculations are estimates and depend on the actual entry and setup.

Green Flags: Keep an eye out for potential signs of a bullish reversal on green days:

Lime Flag: A close above 14680 on a green day could indicate that the daily downtrend bias is in question. This is triggered

1st Green Flag: If the market closes above 14950 on a green day, it may suggest that the short-term weekly downtrend bias is in question. This is also triggered

2nd Green Flag: A significant bullish confirmation could occur if the market closes above 15340 on a green day, potentially voiding the short-term weekly downtrend bias.

#YM_F / #DJI Futures: Tables turned?

📈 Weekly: 🐂 📊 Daily: Cautious 🐻

Analysis:

The bulls made a strong comeback just when the bears were feeling confident, highlighting the unpredictable nature of the market.

Last week's close was above the 2nd Green Flag level of 33815, prompting a change in the weekly bias to bullish.

This suggests that price action is likely to experience more "buy the dip" (BTD) than "sell the rally" (STR) sentiments.

However, the unusual bull run of last week raises caution about a potential pullback, resulting in a cautious bearish bias on the daily chart.

Crucial levels for bulls to defend in any pullback are 33885 and 33335.

The next key resistance level for bulls to target is 34425 to continue their ascent back to September highs.

Monthly Viewpoint:

🐻 Bearish Target: will be decided when a trend changes on the daily chart.

🐂 Bullish Target: 34800/35455

Weekly Perspective:

🐂 Bullish: If 34045/33890 holds or is reclaimed, the levels of 34360 and 34815+ come into play.

🐻 Bearish: If 33890 fails, the market may target 33685/33420-.

Level by Level Bullish Play (on Daily):

If 34045/33890 holds, the next target to watch is 34360.

Once 34360 is claimed, the focus shifts to 34700.

After 34700 is claimed, the next milestone becomes 34815.

Level by Level Bearish Play (on Daily):

If 34045 fails, consider targeting 33920/33890.

If 33890 fails, look for opportunities to go short with a target of 33685.

Should 33685 fail, consider short positions with a target of 33420/33335.

Zoomed-out View:

As long as 33885/33335 holds, the levels of 34815 and 35085 remain in play.

🔑 Key Levels:

Resistance: 34300, 34425*, 34590, 34750, 35085*

Support: 34045, 33890, 33685, 33420/33335, 33010

Example Trade Plans:

Considering the above analysis and key levels, here are some potential trade plans:

Long Trade:

If the market opens lower but holds 34045/33890, consider going long with a stop loss below this level. Initial targets are 34300 and then 34425.

Once 34425 is claimed, look for opportunities to go long with the next target at 34750.

Please note that these risk-to-reward calculations are estimates and depend on the actual entry and setup.

Red Flags: Keep an eye out for potential signs of a bearish reversal on red days:

Orange Flag: A close below 33885, daily uptrend is in question

1st Red Flag: A close below 33335 on a red day may suggest that the short-term weekly uptrend bias is in question.

2nd Red Flag: If the market closes below 32560 on a red day, indicating potential voiding of the short-term weekly downtrend bias.

#RTY_F / #RUT Futures: It’s a good start!

📈 Weekly: Cautious 🐂 📊 Daily: Cautious 🐻

Analysis:

Last week, the Russell 2000 made an impressive and unusual recovery, standing out among the four major indices.

As mentioned last week, #RTY_F was at a crucial decision point, and the bullish close of the week has shifted the weekly bias to bullish for the upcoming week.

However, it's important to note that it came very close to the key 1st Green Flag level at 1780 (reaching a high of 1779.6), which is also near an overhead resistance trend line marked on the chart.

This calls for caution in the weekly bullish bias and maintains a cautious bearish daily bias.

Holding Friday's low is critical for the continuation of this bullish sentiment.

A close above the overhead resistance trend line is likely to initiate more breakout moves, with a quick focus on the 1872 level.

For bulls to gain more confidence for the short to midterm time frame, they need to close above 1780 and 1804.

Monthly Viewpoint:

🐻 Bearish Target: will be decided when a trend changes on the daily chart.

🐂 Bullish Target: 1818.5/1865

Weekly Perspective:

🐂 Bullish: If 1758.5 or 1747 holds or is reclaimed, the levels of 1804 and 1827+ are in play.

🐻 Bearish: If 1720 fails, the market may target 1686/1676-.

Level by Level Bullish Play (on Daily):

If 1758.5/1747 holds, the next target to watch is 1780.

Once 1780 is claimed, the focus shifts to 1804.

After 1804 is claimed, the next milestone becomes 1827.

Level by Level Bearish Play (on Daily):

If 1747 fails, consider targeting 1724.5/1720.

If 1720 fails, look for opportunities to go short with targets at 1704.5.

Should 1704.5 fail, consider short positions with a target of 1686/1676.5.

Zoomed-out View:

Until a green weekly close occurs above 1804, bearish pressure is likely to persist.

🔑 Key Levels:

Resistance: 1780*, 1804*, 1818.5, 1827*, 1848

Support: 1758.5, 1747*, 1724.5/1720*, 1704.5, 1686

Example Trade Plans:

Considering the above analysis and key levels, here are some potential trade plans:

Long Trade:

If the market opens lower but holds 1758.5 or 1747, consider going long with a stop loss below this level. Initial targets are 1780 and then 1804.

Once 1780 is claimed, look for opportunities to go long with the next target at 1827.

Please note that these risk-to-reward calculations are estimates and depend on the actual entry and setup.

Green Flags: Keep an eye out for potential signs of a bullish reversal on green days:

Lime Flag: A close above 1702 on a green day could indicate that the daily downtrend bias is in question. This is already triggered.

1st Green Flag: If the market closes above 1780 on a green day, it may suggest that the short-term weekly downtrend bias is in question.

2nd Green Flag: A significant bullish confirmation could occur if the market closes above 1804 on a green day, potentially voiding the short-term weekly downtrend bias.

#DXY / $USD: Bears hopeful

📈 Weekly: 🐻 📊 Daily: Cautious 🐻

Analysis:

Last week saw a cautious bullish stance on both daily and weekly time-frames.

As mentioned the previous weekend, there were indications that bulls might be fatigued, or bears were beginning to show interest. Consequently, caution was advised for bullish plays.

Early in the week, the market started to move downward, with Monday and Tuesday marking the beginning of this bearish shift. The bounce from the 105.950 level on Tuesday ended in a close below, confirming the bearish move.

Wednesday further affirmed the bearish sentiment by rejecting the initial upside target of 107.06 and continuing its downward trajectory for the remainder of the week.

Friday's close below 105.515 triggered an Orange flag, casting doubt on the daily uptrend bias.

It is now reasonable to anticipate a back test of 105.950 or 106.200, with the potential for a new downward leg if these levels are rejected.

If 106.200 is reclaimed, the next levels where bears may step in are at 106.50 and 106.815.

A successful claim of 106.815 could mark the beginning of a new bullish leg targeting 107.275, 107.750, and beyond.

The ideal scenario is for bears to take control during the back test to 106.200, which could begin on Sunday, Monday, or Tuesday.

In the event that bears continue to move down to 104.420/104.025 during this time frame, they must face off against bulls at 105.515 during any back test; otherwise, bulls could start gaining strength.

It's important to note that the inverse correlation between the USD and #NQ #ES observed last week is still holding.

🔑Key Levels:

Resistance: 105.515, 105.950, 106.200, 106.50/106.815, 107.275, 107.750

Support: 104.420, 104.025, 103.615, 103.270, 103.010

Red Flags: Keep an eye out for potential signs of a bearish reversal on red days:

Orange Flag: A close below 105.515 on a red day, indicates daily uptrend is in question. This is triggered on Friday.

1st Red Flag: A close below 104.420 on a red day may suggest that the short-term weekly uptrend bias is in question.

2nd Red Flag: If the market closes below 104.025 on a red day, indicating potential voiding of the short-term weekly downtrend bias.

Note about Terminology:

In my weekly reports and X (Twitter) posts, I often refer to terms like "must hold," "claim," or "fail." Here's a quick explanation of what these terms mean:

For intraday analysis: I consider the 15-minute or 1-hour candle close.

For trades spanning overnight to two days: I focus on the 4-hour candle close.

For a weekly or longer-term outlook: I rely on the daily candle close.

close above: claimed / close below: failed

These references are also available in the pinned thread on my X profile. I strongly recommend reading that thread for a deeper understanding of my chart analysis. While I plan to elaborate on my methodology in a separate Substack post in the future, the pinned thread on my X profile offers valuable insights for now.

Stay alert and adjust your strategies according to market conditions and the mentioned support and resistance levels. Monitor flag levels for early signs of bias shifts. If you're not following me on X @trdnvestor , consider doing so for daily updates.

Wish you double profitable week!

Disclaimer: This is NOT financial advice. I am NOT a financial advisor.

Lot’s of nuggets in this update. Strong logic. Thank you!

Thank you Trd. I'm new to trading and trying to follow you. "Wait for the market to reclaim 4390, and look for signs that 4385/4375 is holding"

Could you explain a bit about this? What would be signs that a lower level is holding if a higher level is reclaimed? Thank you so much.