Weekly Charts Reading for 11/20 - 11/24

GratefulGains

How’s last week?

Anticipated a continuation of bullish momentum early last week, and that's precisely what unfolded, evident in the robust bullish moves on Monday and notably on Tuesday.

All index futures not only met but surpassed their weekly bullish targets while steadfastly maintaining the identified key support levels.

On the preceding Sunday and Monday, #DXY bears stood their ground precisely at 105.950 (105.956 high), and as predicted, a significant downward movement transpired on Tuesday.

Read here how I use this Weekly Newsletter in my daily trading

I am curious about your trading experiences. Share your trading moves inspired by this newsletter – the wins, the almost-wins, and the lessons learned or what you would like to cover more or less. Drop your insights in the comments below or over on X (formerly Twitter). Let's learn and grow together!

Week Ahead (11/20 – 11/24)

Friday's slight weakness might extend into Sun/Mon until key support levels are tested.

Note: Equities market closed on Thanksgiving Thursday, with a noon close on Friday. Emini futures open till 1 pm EST on Thursday and resume at 6 pm EST. Friday's close at 1 pm EST for the week.

Factors Favoring Bears:

Geopolitical conflicts and macro conditions.

Smaller timeframe indicates early signs of bulls pausing after a strong 3-week bullish move.

Most indices at or near their weekly/monthly resistance levels.

FOMC meeting minutes on Tuesday.

Factors Favoring Bulls:

All four indices display continued bullish strength. Even #RTY close on Tuesday triggered 2nd Green Flag.

As expected, #DXY triggered the 2nd Red flag on Friday, expecting a continued downward move, which could lift #NQ & #ES up.

Shortened holiday week with light trading volume.

Note: My expertise doesn't extend to geopolitics or macro / micro economic analysis. Therefore, I categorize geopolitical conflicts and macroeconomic conditions as factors that favor the bears, as they often introduce uncertainty and challenges to the market.

Feel free to scroll down to the end of the report to get a rundown on some of the terms I'm throwing around, like "hold," "claim," and “fail”

Disclaimer: This is NOT financial advice. I am NOT a financial advisor.

Events Calendar:

Next week's highlight is the FOMC meeting minutes set for release on Tuesday at 2 pm. Additional economic indicators include Unemployment Claims and Consumer Sentiment on Wednesday, followed by PMI on Friday. Anticipate lower trading volumes due to the shortened holiday week.

#ES_F / $SPX Futures: Why stop now?

📈 Weekly: Cautious 🐂 📊 Daily: Cautious 🐻

Daily: Link

Analysis:

Last week demonstrated robust bullish momentum, with a notable breakthrough on Tuesday as the price surpassed the downtrend line visible on the daily chart.

Now, back test of breakout levels are 4482, 4472.

For the past three days, the price has predominantly oscillated within the narrow range of 4514-4540.

If the levels around 4514, especially during Sunday and Monday, hold firm, a renewed effort to reach 4540 is conceivable.

A successful claim of 4540 could pave the way for a bullish ascent towards 4562 and potentially 4580.

Conversely, if support weakens and 4502 fails to hold, a retest of 4482/4472 becomes likely, aligning with the typical back testing behavior.

In the event of continued Friday weakness, a drop to 4502, and even 4482, could materialize. A swift recovery from 4482/4472 after testing would sustain bullish momentum.

A close below 4502 would signal a potentially red next few days.

Monthly Viewpoint:

🐂 Bullish Goal: Targeting 4515/4562

🐻 Bearish Goal: To be determined based on daily trend changes

Weekly Perspective:

🐂 Bullish: 4514/4502 support holding suggests potential for 4562/4580+

🐻 Bearish: A failure at 4502 could lead to 4482/4435 as support/targets.

Level by Level Bullish Play (on Daily):

If support at 4514/4502 holds, targeting 4558/4562 next.

Upon claiming 4562, focus shifts to 4580/4603.

A close above 4603 sets sights on 4621/4636.

Level by Level Bearish Play (on Daily):

If 4502 fails, targeting 4482/4472.

If 4472 gives way, next support is at 4435.

A breach of 4435 opens the door to 4420/4406 on the downside.

Zoomed-out View: As long as bulls maintain control above 4482/4472, the path towards 4562/4621/4667 remains plausible. A red day closing below 4472, however, would negate last week's bullish momentum.

🔑 Key Levels:

Resistance: 4540, 4562*, 4580*, 4603, 4621

Support: 4514, 4502, 4482/4472*, 4447/4435, 4420

Possible Trade Plans:

Long Trade:

If the market opens lower but holds 4502, consider a long position with a stop loss below 4502. Targets: 4515, 4430, 4540.

If the market opens lower but maintains 4514, consider a long position with a stop loss below 4514. Targets: 4440, 4558.

Wait for the market to claim 4540, observe 4530 holding, and enter a long position with a stop loss below 4530. Targets: 4558, 4562.

If market hasn't reached 4558 and shows signs of 4502 support, consider a long entry at 4502 with a stop loss below 4502. Targets: 4540, 4558.

Short Trades:

If the market opens higher but fails to hold 4530/4535, consider shorting with a stop loss above 4535. Targets: 4514, 4502.

If the market fails to hold 4502, and bears reject the 4514 level, assess for a short position with a stop loss just above 4514. Target: 4482/4472.

Note: These examples illustrate my approach to the levels. Variations may occur based on actual entry and market conditions.

Red Flags: Keep an eye out for potential signs of a bearish reversal on red days:

As market moved up, flag levels moved up for early detection of short term trend change as below

Orange Flag: A close below 4502 questions the daily uptrend.

1st Red Flag: A close below 4420 on a red day suggests a potential shift in the short-term weekly uptrend bias.

2nd Red Flag: If the market closes below 4354 on a red day, it indicates a possible voiding of the short-term weekly uptrend bias.

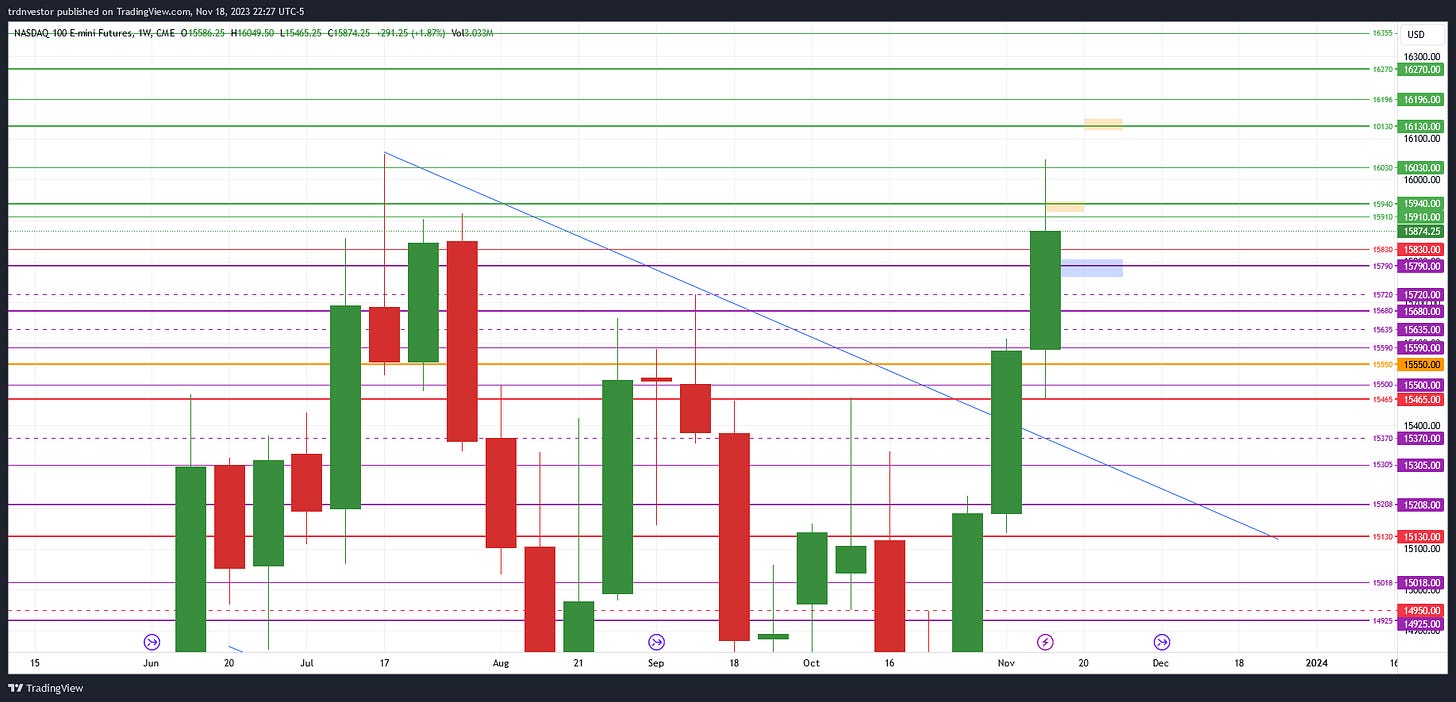

#NQ_F / #NDX Futures: Moving closer to ATH

📈 Weekly: Cautious 🐂📊 Daily: Cautious 🐻

Daily: Link

Analysis:

The weekly close maintained a bullish tone, although Friday's closure lacked the same bullish momentum.

Notably, bears defended the key resistance of 15940 for the last three days, creating a consolidation range between 15830 and 15940. This pattern suggests a potential build-up for a larger move.

Consequently, there is a cautious bearish bias on the daily timeframe, coupled with a cautious bullish outlook for the week.

After three consecutive strong weeks for the bulls, a pause is observed on smaller timeframes. Yet, on the daily and weekly scales, there are no clear indications that bulls are relinquishing control.

Adding to the cautious sentiment is the upcoming shortened week due to holidays, prompting vigilance on both timeframes.

If Friday's weakness extends to Sunday/Monday, key levels at 15830/15790 become crucial for the bulls to defend.

A breach below 15790 would not only shift the daily bias to bearish but also signal a potentially bearish week ahead.

A failure at 15830 could lead to a sharper pullback to 15720, a scenario that would favor bears. However, a swift recovery above 15790 on the same day would nullify the breakdown.

Conversely, if 15790 fails to hold or recover promptly, bearish plays will be considered.

Holding at 15830 or, at the least, 15790, could pave the way for a bullish move targeting 16130 in the next shortened trading week. Notably, 15940 remains a key resistance for the bulls to overcome.

In summary, the stance is bullish above 15790 and bearish below, with 15940 acting as a pivotal resistance before 16130 comes into play.

If 15790 fails, there is a likelihood of revisiting the post-PPI report move from Tuesday (15635/15590).

Monthly Viewpoint:

🐂 Bullish Target: 16065/16130

🐻 Bearish Target: To be determined based on daily trend changes

Weekly Perspective:

🐂 Bullish: 15830/15790 holds or reclaimed, 16130+ is in play

🐻 Bearish: 15790 fails, 15680/15590- is in play

Level by Level Bullish Play (on Daily):

If 15830/15790 holds or is reclaimed, 15940 is in play

Once 15940 is claimed, 16130 becomes the next target

Upon securing 16130, the focus shifts to 16270

Level by Level Bearish Play (on Daily):

If 15790 fails, targeting 15680

If 15680 gives way, 15590 is the next support

A breach of 15590 opens the door to 15550/15500

Zoomed-out View: As long as 15830/15790 holds or is reclaimed, the path towards 16130+ remains in play.

🔑 Key Levels:

Resistance: 15910/15940, 16030, 16130, 16196, 16270

Support: 15830/15790, 15720/15680, 15635/15590, 15550, 15500

Possible Trade Plans:

Long Trade:

Depending on the price's position before reaching the three key support levels (15830, 15790, and 15720), various potential trade opportunities may arise.

If the market hasn't reached 16130 and reclaims 15940, look for signs of holding 15910, then go long with a stop loss below 15910, targeting 16030 and 16130.

Short Trade:

If the market opens higher or lower (but 15790 isn't yet tested), look for signs of rejection of 15910/15940 on a lower timeframe. Go short with a stop loss above 15910/15940 and targets at 15790 and 15720.

Note: These are example plans to illustrate the approach to the levels, and adjustments may be made in real-time based on price action dynamics.

Red Flags: Keep an eye out for potential signs of a bearish reversal on red days:

As market moved up, flag levels moved up for early detection of short term trend change as below

Orange Flag: A close below 15550 questions the daily uptrend.

1st Red Flag: A close below 15208 on a red day may suggest a potential shift in the short-term weekly uptrend bias.

2nd Red Flag: If the market closes below 15130 on a red day, it indicates a possible voiding of the short-term weekly uptrend bias.

#YM_F / #DJI Futures: Breakout to hold?

📈 Weekly: Cautious 🐂 📊 Daily: Cautious 🐂

Daily: Link

Analysis:

As anticipated after the tight range action two weeks ago, the market displayed a significant and robust bullish continuation last week.

The week concluded with another strong bullish close, although Friday's closure showed some signs of weakness.

The 34895 level is critical and must hold for a cautious bullish sentiment on both the weekly and daily timeframes.

Based on last week's close, as long as 34950/34895 holds, the move to 35285/35350 remain in play.

Bulls need to swiftly claim 35120 and maintain 35055 afterward for a bullish scenario.

If 35055/35120 is rejected, the support at 34895 is likely to be tested again. If it holds, another range-bound day could be expected.

Essentially, a breakout of the 34895-35120 range is required to determine a directional move.

Monthly Viewpoint:

🐂 Bullish Target: 35455

🐻 Bearish Target: To be determined based on daily trend changes

Weekly Perspective:

🐂 Bullish: If 34950/34895 holds or is reclaimed, 35285/35350+ is in play

🐻 Bearish: If 34895 fails, 34695/34425- is in play

Level by Level Bullish Play (on Daily):

If 34950/34895 holds, 35120 is in play

Once 35120 is claimed, 35285/35350 comes into focus

Upon securing 35285, the target shifts to 35455

Level by Level Bearish Play (on Daily):

If 34895 fails, targeting 34756/34695

If 34695 gives way, 34590 is the next support

A breach of 34590 opens the door to 34425/34335

Zoomed-out View: As long as 34695 holds or is reclaimed, the path towards 35455/35650 remains in play.

🔑 Key Levels:

Resistance: 35055/35120*, 35170, 35285, 35350*, 35455*

Support: 34950/34895*, 34756, 34695*, 34590, 34425/34335*

Possible Trade Plans:

Long Trade:

Depending on the price's position before reaching the two key support levels, 34950 and 34895, various potential long trade opportunities may arise.

If the market hasn't reached 35285 and reclaims 35120, look for signs of holding 35055, then go long with a stop loss below 35055, targeting 35285 and 35350.

Short Trade:

If 34895 isn't yet tested, after the market opens, look for signs of rejection of 35055/35120 on a lower timeframe and go short with a stop loss above 35055/35120 and targets at 34950 and 34895.

If 34895 fails, depending on the actual setup, go short near 34950 with a stop loss above 34756, targeting 34695.

Note: These are example plans to illustrate the approach to the levels, and adjustments may be made in real-time based on price action dynamics.

Red Flags: Keep an eye out for potential signs of a bearish reversal on red days:

As market moved up, flag levels moved up for early detection of short term trend change as below

Orange Flag: A close below 34895 questions the daily uptrend.

1st Red Flag: A close below 34335 on a red day may suggest a potential shift in the short-term weekly uptrend bias.

2nd Red Flag: If the market closes below 34200 on a red day, it indicates a possible voiding of the short-term weekly uptrend bias.

#RTY_F / #RUT Futures: Nice move bulls!

📈 Weekly: Cautious 🐂 📊 Daily: Cautious 🐂

Daily: Link

Analysis:

Last week demonstrated a precise hold of the 1695 support on Sunday/Monday, followed by a significant move on Tuesday that surpassed all weekly targets.

This marked another strong bullish week after a brief back test and cooling-off period the week before.

Following such a robust move, the focus was on a week close above 1804, a crucial level to alleviate bear pressure.

Nonetheless, Tuesday's candle not only closed above 1804 but also broke out of the downtrend line, making it a key reference point, especially the breakout levels.

A close above 1827 is pivotal for any upside continuation toward 1872/1924+.

Anticipating a shallower pullback to 1790/1783 on Sunday/Monday, with a bounce potentially leading to another attempt to claim 1827. Bulls need to overcome the first hurdle at 1811.

The caution arises from the fact that if Friday's close had been above 1811 or at least 1804, there would have been more confidence in a further bullish move.

Caution is added on the weekly chart, while on smaller timeframes, bulls seem interested and have not given up, prompting caution on the daily as well.

Expecting an upside move on Sunday/Monday, with 1827 as the likely key resistance.

Key levels for bulls to hold this week are 1783 & 1770. If 1770 fails, a quick flush to 1762, followed by a recovery above 1770 and a close, would still be considered bullish (failed breakdown).

A close below 1770 could initiate a short-term move to the downside, with a back test of Tuesday's breakout levels of 1747, 1734 & 1718.5 likely.

A red day close below any of these levels would weaken the bulls, casting doubt on the weekly uptrend.

Notably, Tuesday broke out of the trend line at 1747 (identified as the trend line breakout level last week). As long as bulls hold 1747 or at least 1734 on the daily, this bullish move remains secure.

Monthly Viewpoint:

🐂 Bullish Target: 1865/1872

🐻 Bearish Target: 1686/1665

Weekly Perspective:

🐂 Bullish: If 1790 or 1783 holds or is reclaimed, 1848/1865 is in play

🐻 Bearish: If 1770 fails, 1734/1718.5- is in play

Level by Level Bullish Play (on Daily):

If 1790/1783 holds, 1827 is in play

Once 1827 is claimed, 1848 comes into focus

Upon securing 1848, the target shifts to 1865

Level by Level Bearish Play (on Daily):

If 1770 fails, targeting 1747

If 1747 gives way, 1734 is the next support

A breach of 1734 opens the door to 1718.5/1707

Zoomed-out View: As long as 1747 or 1734 holds, 1872/1922 is likely to be tested.

🔑 Key Levels:

Resistance: 1811/1818.5, 1827, 1838, 1848, 1865

Support: 1790/1783, 1770, 1747, 1734, 1718.5/1707

Possible Trade Plans:

Long Trade:

If signs of holding 1704 on a lower timeframe are observed, go long with a stop loss below 1704 and 1718.5 as the first target.

If signs of holding 1695 on a lower timeframe are evident, and 1718.5 has not yet been tested, go long near 1695 with a stop loss below 1695. Targets: 1718.5, 1734, 1747.

Short Trade:

If the price hasn't hit 1704 yet and signs of 1718.5 getting rejected are observed, enter a short position with a stop loss above 1720. Targets: 1704 and 1695.

If 1695 fails, depending on the actual setup, go short near 1695/1697 with a stop loss above 1699. Targets: 1686 and 1676.

Note: These are example plans to illustrate the approach to the levels, and adjustments may be made in real-time based on price action dynamics.

Red Flags: Keep an eye out for potential signs of a bearish reversal on red days:

As market moved up, flag levels moved up for early detection of short term trend change as below

Orange Flag: A close below 1770 questions the daily uptrend.

1st Red Flag: A close below 1734 on a red day may suggest a potential shift in the short-term weekly uptrend bias.

2nd Red Flag: If the market closes below 1707 on a red day, it indicates a possible voiding of the short-term weekly uptrend bias.

#DXY / $USD: Bears got the go ahead

📈 Weekly: 🐻 Daily: Cautious 🐻

Analysis:

Finally, both red flag 1 and 2 were triggered on Tuesday and Friday, leading to a shift in the weekly bias to bearish.

Adding caution to the daily bearish bias as, after the second red flag was triggered, there's a likelihood of a back test of the beginning of that move.

The key for bears now is to hold 104.025 or at least 104.420 and swiftly push it below 103.615.

As long as 104.420 holds, in any sharp retest bounce, 103.010 becomes the next target, with 103.615 offering intermediate support.

Above 104.560, bears start getting nervous.

Note that the inverse correlation between USD and #NQ #ES is continuing.

🔑 Key Levels:

Resistance: 104.025, 104.420, 104.560, 105.735, 106.670

Support: 103.615, 103.010, 102.420, 101.960

Green Flags: Keep an eye out for potential signs of a bullish reversal on green days:

Lime Flag: A close above 104.560 on a green day could indicate that the daily downtrend bias is in question.

1st Green Flag: If the market closes above 105.735 on a green day, it may suggest that the short-term weekly downtrend bias is in question.

2nd Green Flag: A significant bullish confirmation could occur if the market closes above 106.670 on a green day, potentially voiding the short-term weekly downtrend bias.

Note: These green flags are crucial for monitoring potential shifts in the bearish bias. Adjustments to trading plans may be necessary based on real-time price action dynamics.

Note about Terminology:

In my weekly reports and X (Twitter) posts, I often refer to terms like "must hold," "claim," or "fail." Here's a quick explanation of what these terms mean:

For intraday analysis: I consider the 15-minute or 1-hour candle close.

For trades spanning overnight to two days: I focus on the 4-hour candle close.

For a weekly or longer-term outlook: I rely on the daily candle close.

close above: claimed / close below: failed

These references are also available in the pinned thread on my X profile. I strongly recommend reading that thread for a deeper understanding of my chart analysis. While I plan to elaborate on my methodology in a separate Substack post in the future, the pinned thread on my X profile offers valuable insights for now.

Curious about your trading experiences. Share your trading moves inspired by this newsletter – the wins, the almost-wins, and the lessons learned. Drop your insights in the comments below or over on X (formerly Twitter). Let's learn and grow together!

Be nimble and adjust your strategies according to market conditions and the mentioned support and resistance levels. Monitor flag levels for early signs of bias shifts. If you're not following me on X @trdnvestor , consider doing so for daily updates.

Let's express gratitude to the market for its teachings and appreciate all that we receive.

Thank you for continued support and encouragement.

Have a grateful week!

Disclaimer: This is NOT financial advice. I am NOT a financial advisor.